Know Your Investor: RA Capital Management LLC

Shots:

- PharmaShots’ second dose of the Know Your Investor series focuses on RA Capital Management LLC. Know Your Investor is an earnest effort from PharmaShots to acquaint our readers with leading Investors and venture capital firms in the healthcare industry

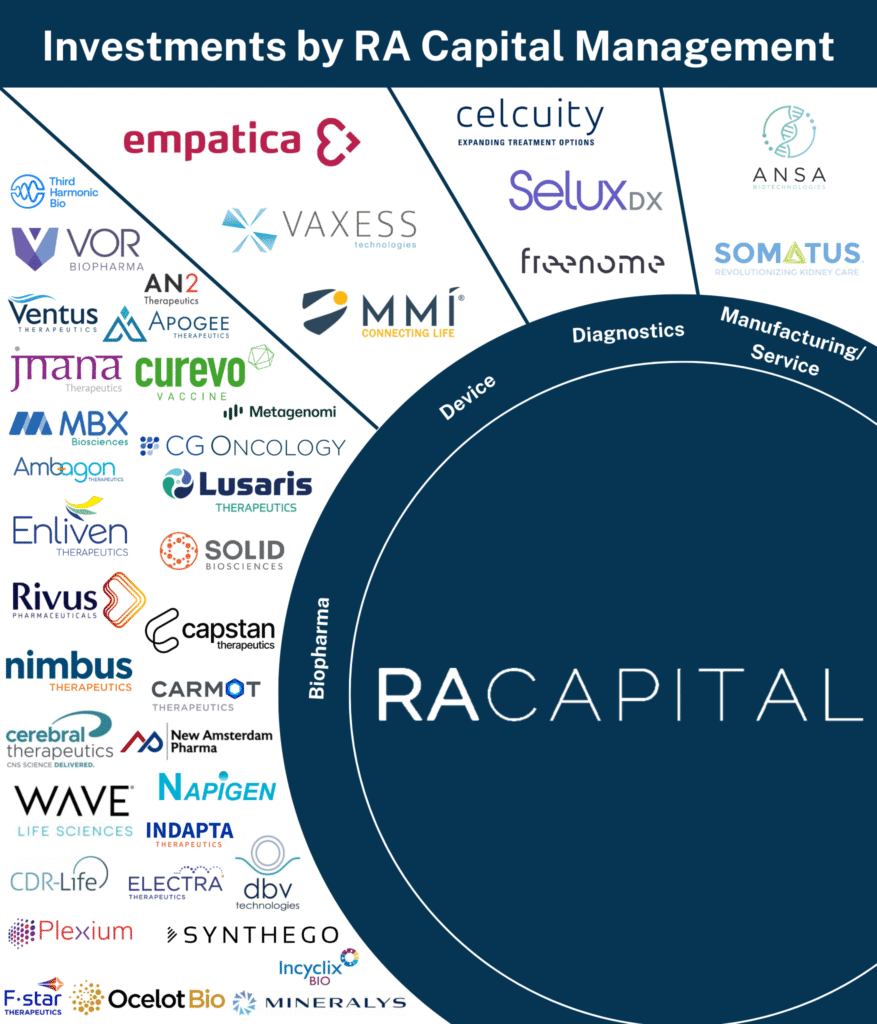

- Founded in 2002, RA Capital forged ahead to become a key investor in life science and healthcare companies. In 2022, RA Capital closed 42 major investments in biopharma companies, devices, manufacturing, service offering firms, and diagnostics

- An illustrative table concludes the report, listing five major investments out of 42. For a complete report reach out to us at connect@pharmashots.com with the subject line RA Capital Management Data

RA Capital Management LLC

In 2002, Richard Aldrich and Peter Kolchinsky laid the foundation of RA Capital Management, an American multi-stage investment firm. RA Capital profusely makes public and private investments in Healthcare and Life Science companies. Headquartered in Massachusetts, United States, the company initially began investing in public companies and later started investing in private companies. RA Capital made its first private investment in T2 Biosystems worth $15M as a part of Series C funding in the year 2010. Today RA Capital’s business spans around the globe through funding made to companies focusing on therapy areas across all stages from discovery through commercialization.

RA Capital’s in-house research group, TechAtlas, is a scientifically trained team that maps competitive landscapes to curate the data into context, identify breakthroughs, and originate conviction in new ideas. TechAtlas acts as a resource provider of market intelligence and technical diligence to the company’s internal investment team and portfolio companies. The company leverages data collected from case studies, the impact of clinical trial designs, partnership structures, and public market dynamics. RA Capital offers Executive-In-Residence (EIR) and venture partner programs to drug hunters and company builders through its in-house incubator, RAVen

In 2022, RA Capital Management closed around 42 investments made majorly to Biopharma Companies, Devices, Diagnostics, and Manufacturing or Service providing firms. The company diversified its investments into Oncology, Endocrine/Metabolic Disorders, Infectious Diseases, Autoimmune Disorders, Cardiovascular, etc. The technologies that received RA Capital’s investment include small molecules, Gene Therapy, Immunotherapy, Antibodies, Stem Cells Therapies, etc. Out of the total investments made by RA Capital in 2022, 57% were under Series A or Series B. The top 3 investments made by RA Capital were:

- Series E funding worth $325M to Somatus

- Series D funding worth $300M to Freenome

- Series B funding worth $275M to Metagenomi

With a total of 34 investments, RA Capital Management made the highest funding rounds in Biopharma companies which included Metagenomi, Synthego, Carmot Therapeutics, Apogee Therapeutics, etc. Metagenomi received the highest funding worth $275M from RA Capital Management.

Under the diagnostics domain Freenome received $300M, Celcuity received $100M whereas SeLux Diagnostics received $50M.

In terms of technology, RA Capital invested majorly in companies developing therapies associated with small molecules. Of these companies, New Amsterdam Pharma received a total of $235M, Enliven Therapeutics received $165M, Carmot Therapeutics received $160M, and Ventus Therapeutics received $140M from RA Capital Investments.

In 2022, RA Capital participated in around 16 funding rounds in Q1, 8 rounds in Q2 & Q3, and 10 rounds in Q4.

The table below represents the top 5 funding rounds out of the 42 investments made by RA Capital Management in 2022. (For a complete report, reach out to us at connect@pharmashots.com with the subject line “RA Capital Management Data”)

Related Posts: Know Your Investor: Qiming Venture Partners