The 2025 Playbook: Industry Trends Shaping the Future of Biopharma

Shots:

- 2025 marked a decisive inflection point for the global life sciences and biopharma industry. After several years defined by experimentation, abundant capital, and expansive innovation narratives, the industry entered a phase of disciplined execution.

- Strategies were stress-tested, science was closely scrutinized, and only programs with clear biological rationale and operational readiness advanced.

- Rather than another cyclical adjustment, 2025 represented a structural reset in how innovation is discovered, financed, regulated, manufactured, and scaled. This report outlines the key forces that shaped the year, highlighting the strategic shifts, performance indicators, and market dynamics that redefined global biopharma.

From Experiments to Infrastructure

Artificial intelligence reached a critical maturity point in 2025. No longer limited to hypothesis generation or pilot initiatives, AI became embedded within core R&D infrastructure. Platforms began delivering clinical-stage assets, reshaping how targets were validated, trials were designed, and pipelines were constructed.

This transition had a direct impact on dealmaking behavior. Large pharmaceutical companies moved away from short-term AI collaborations toward outright acquisitions of AI-native biotechs, seeking ownership of data, platforms, and decision-making capabilities.

Key insight: AI evolved from a supporting tool into a production-grade engine for drug development.

Capital With Conviction

The funding environment in 2025 became notably more selective. Capital allocation shifted toward programs with validated biology, platform depth, and clear clinical pathways. While overall deal volumes moderated, transaction quality improved.

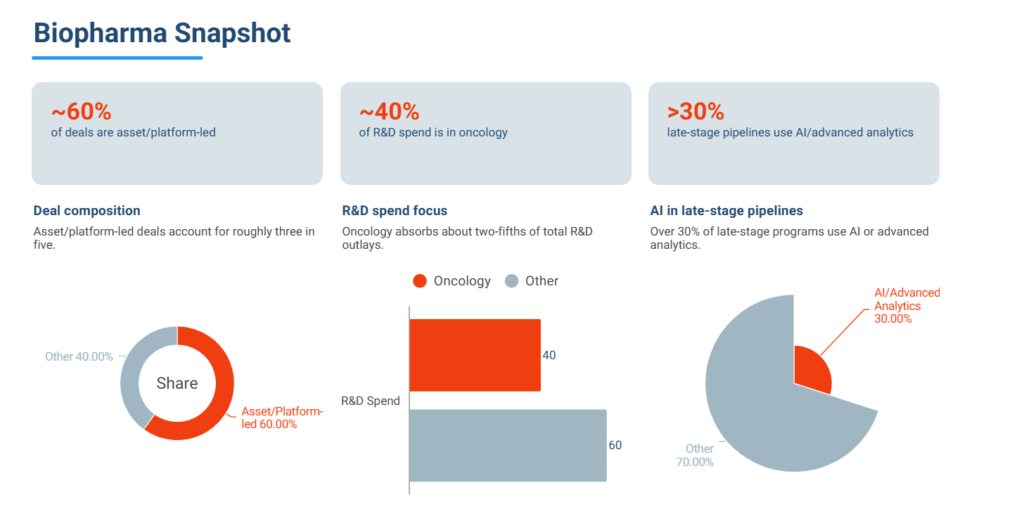

Approximately 60% of global biopharma deals were asset- or platform-led, reinforcing a market preference for proof-driven investment strategies over broad thematic narratives.

Key insight: Capital increasingly followed demonstrated execution rather than early-stage promise.

Oncology, Reimagined

Oncology continued to dominate global R&D investment, accounting for roughly 40% of total spend, but the nature of innovation evolved. The industry moved beyond overcrowded PD-(L)1 pathways toward next-generation approaches such as multispecific antibodies, antibody–drug conjugates, and refined cell therapies.

Differentiation became essential, as incremental innovation struggled to compete in both regulatory and commercial environments.

Key insight: Sustained participation in oncology now requires continuous reinvention and clear clinical differentiation.

Regulators as Enablers

Regulatory frameworks also evolved meaningfully in 2025. Global regulators increasingly adopted accelerated approval pathways, adaptive trial designs, and real-world evidence to support decision-making. Alignment across regions improved, and expedited designations expanded across oncology, rare diseases, and CNS.

These changes contributed to shorter approval timelines and earlier patient access to innovation.

Key insight: Regulation became a catalyst for innovation rather than a limiting factor.

Manufacturing as a Strategic Lever

Manufacturing emerged as a core strategic consideration. Rising biologics complexity, supply-chain risk, and geopolitical uncertainty prompted companies to rethink manufacturing from the earliest stages of development.

Near-shoring, modular production models, and advanced CDMO partnerships became critical enablers of post-approval scalability and commercialization speed.

Key insight: Manufacturability increasingly influenced pipeline prioritization and development strategy.

The Numbers That Defined 2025

- ~60% of global biopharma deals were asset- or platform-led

- ~40% of R&D spend remained concentrated in oncology, under higher differentiation thresholds

- >30% of late-stage pipelines incorporated AI or advanced analytics

Collectively, these indicators highlight an industry prioritizing focus, precision, and readiness over volume-driven expansion.

The Unexpected Disruption

One of the most notable shifts in 2025 was Big Pharma’s pivot from partnerships to acquisitions. Years of collaboration-heavy dealmaking gave way to a preference for full ownership, driven by the need for control over data, IP, and development timelines.

In several cases, platform acquisitions were completed prior to first-in-human data—an approach once considered high risk. This shift reduced governance complexity and accelerated translation from discovery to patient impact.

Key insight: Ownership replaced optionality as the preferred model for strategic innovation.

Accelerating Science in 2025: Innovation Delivered at Scale

The 2025 approval landscape reflected an industry that had moved beyond experimentation into disciplined execution. Innovation was rewarded not for novelty alone, but for precision, clinical proof, and scalability.

Precision Became the Baseline

Biomarker-driven approvals underscored a decisive shift toward defined patient populations and mechanistic clarity. Key examples included:

- Datroway (datopotamab deruxtecan) in HR-positive breast cancer

- Lynozyfic (linvoseltamab) in relapsed or refractory multiple myeloma

Broad, undifferentiated hypotheses increasingly failed to meet regulatory and payer expectations.

Innovation signal: Precision became a prerequisite rather than a competitive advantage.

Platforms Outperformed Single-Asset Strategies

Approvals in rare and genetic diseases reinforced the value of scalable platforms. Therapies such as Kygevvi (TK2 deficiency), Forzinity (Barth syndrome), Redemplo (familial chylomicronemia syndrome), and Sephience (phenylketonuria) demonstrated how repeatable biology paired with adaptive trial designs could unlock approvals in small populations.

Innovation signal: Repeatability and platform depth outperformed one-time clinical success.

Speed Was Engineered

Faster development timelines in 2025 were driven by improved trial design and regulatory alignment rather than compressed execution. Therapies such as Myqorzo (aficamten) in hypertrophic cardiomyopathy and Cardamyst (etripamil) in PSVT highlighted how mechanistic clarity enabled efficient development outside oncology.

Innovation signal: Speed emerged as an outcome of strategy, not urgency.

Infectious Diseases Regained Momentum

Anti-infective innovation quietly regained relevance in 2025. Approvals such as Nuzolvence (zoliflodacin) for gonorrhea, Blujepa (gepotidacin) for UTIs, Yeytuo (Lenacapavir) for HIV prevention, and Enflonsia (clesrovimab) for RSV prevention reflected renewed confidence in differentiated infectious disease science.

Innovation signal: High-impact innovation returned to areas long viewed as commercially challenging.

Execution as the Ultimate Differentiator

Across approvals, pipelines, and transactions, one unifying theme defined 2025: innovation without execution did not progress. This reality directly influenced M&A strategy and portfolio decision-making.

M&A Highlights: Where Pharma Placed Its Biggest Bets in 2025

Pharma M&A activity in 2025 reflected a strategic recalibration. While overall deal volumes remained measured, the largest transactions were highly targeted, emphasizing platform scalability, therapeutic depth, and long-term growth visibility.

Johnson & Johnson Acquires Intra-Cellular Therapies

Deal Value: $14.6 billion

Strategic Focus: Neuroscience and mental health

The acquisition strengthened J&J’s CNS portfolio, anchored by Caplyta, and signaled renewed confidence in psychiatric drug development.

Novartis Acquires Avidity Biosciences

Deal Value: $12 billion

Strategic Focus: RNA-based therapies and rare neuromuscular diseases

The transaction reinforced Novartis’ focus on platform-driven innovation and repeatable RNA technologies.

Deal Value: Approximately $10 billion

Strategic Focus: Obesity and cardiometabolic diseases

The deal underscored intense competition for differentiated assets in high-growth metabolic markets.

Key Strategic Signals from 2025 M&A Activity

- Renewed focus on neuroscience supported by improving clinical confidence

- Premium valuations for scalable platform technologies, particularly RNA-based approaches

- Competitive bidding for assets in obesity and cardiometabolic diseases

- Preference for full ownership of clinically and commercially visible assets

Looking Ahead to 2026: Momentum, Not Reset

If 2025 was the year biopharma chose execution, 2026 is poised to be the year that execution compounds.

The industry enters 2026 leaner, more disciplined, and strategically aligned. Artificial intelligence is no longer experimental—it is embedded across R&D, enabling better decisions and higher clinical confidence. Capital is returning with sharper focus, flowing toward platforms, late-stage assets, and companies built to scale.

Oncology innovation is accelerating into its next wave, powered by ADCs, multispecific antibodies, and smarter patient stratification. At the same time, regulatory flexibility and adaptive trial designs are shortening the distance between discovery and patients, while manufacturing readiness is emerging as a true competitive advantage.

M&A is evolving from defensive pipeline-filling to offensive growth-building, centered on platforms that can generate repeatable value. Taken together, these forces signal an industry moving forward with clarity and confidence.

2026 will not be about rebuilding momentum—it will be about sustaining it.