Deal Maker of the Year 2021 (Part 02)

Shots:

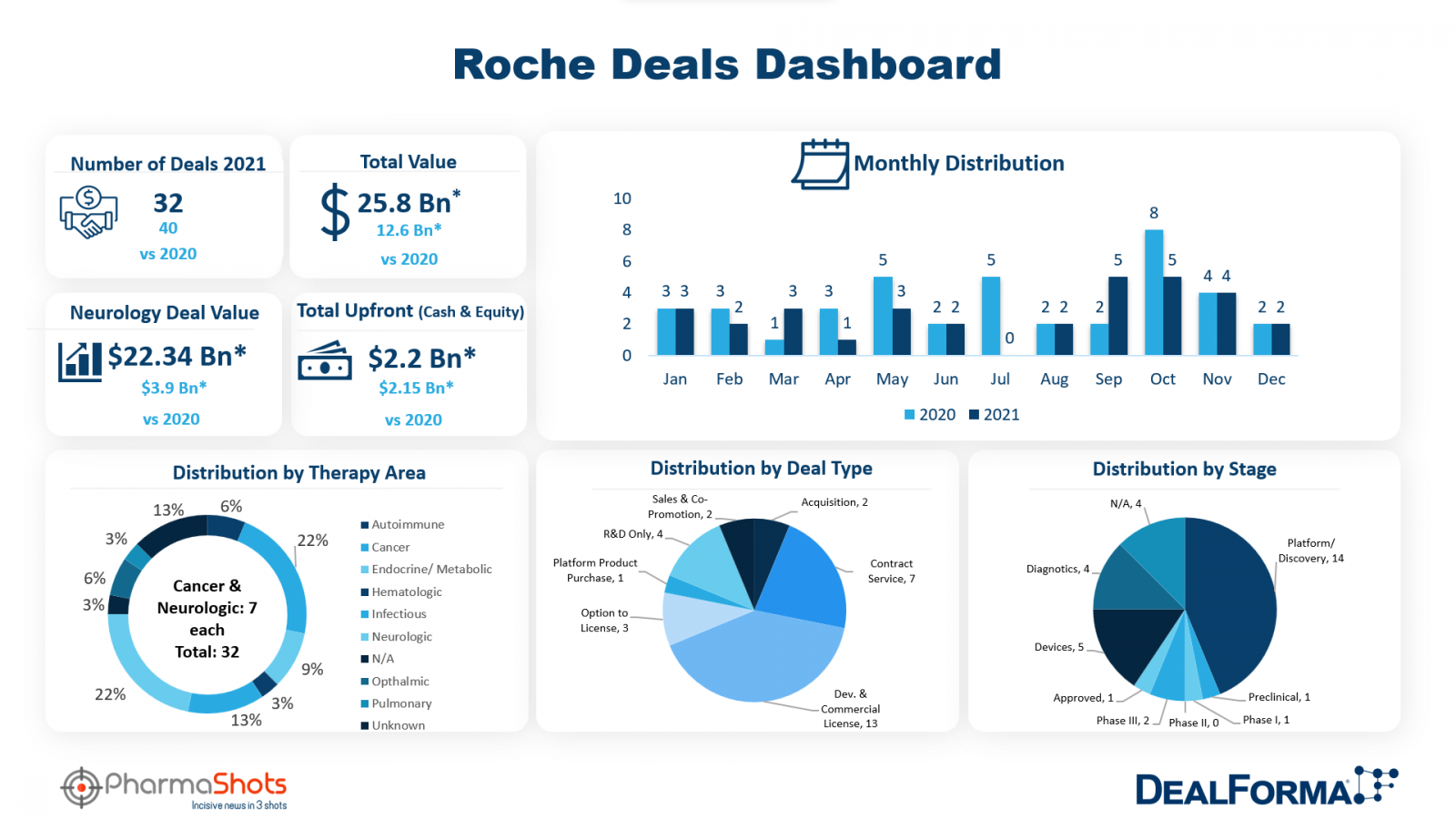

- Roche was at the top with 32 deals for a total announced deal value of ~$25.83B with multiple biopharma companies

- The highest value deal was Roche’s AI pact with Recursion valued at up to ~$12B to identify and develop up to 40 new medications in neuroscience and oncology indications

- Pfizer and Merck are two of the most active dealmakers. PharmaShots leverages the data from DealForma for creating the insightful data for Deal Maker of the Year

Summary

Throughout 2021, deal making reached new heights, organizations worked with one another, sharing risks, resources, and possible gain. Several licensing agreements, mergers and acquisitions, megamergers, and development and commercial agreements are a part of this year. But still, 2021 was quieter than in previous years. Considering all the deals in account (except CTA), our team at PharmaShots worked on the Deal Maker of the Year based on the biggest total announced deal value. PharmaShots uses data from DealForma to keep track of the Deal Maker of the Year, 2021.

Pfizer, Merck, and Roche are the leaders in the race. Roche topped the ladder by collaborating with the highest number of deals (n= 32), making a total announced deal value of ~$25.83B. Roche made a maximum number of its deals in oncology and neurology, followed by a few deals in the infectious, metabolic, pulmonary and ophthalmic space. In total, Roche signed 32 deals (excluding CTAs) out of which a maximum number of deals are development and commercial licensing agreements (n=13), followed by contract services agreements (n=7). Roche also signed 1 platform purchase agreement, 3 option to license agreements, and 2 sales and co-promotion deals. Moreover, 2021 witnessed 2 M&As by Roche, which included the acquisition of GenMark for $1.8B and the acquisition of the TIB Molbiol Group for an undisclosed value. Roche’s top deal was its collaboration with Recursion leveraging technology-enabled drug discovery through the Recursion Operating System (OS) to identify novel targets and advance medicines in key areas of neuroscience as well as in an oncology indication. As compared to 2020, Roche has made fewer deals this year (in 2020, it was 40), but the total deal value increased where last year it was ~$12.57B.

PharmaShots has worked on Deal Maker of the year, considering two criteria: the number of deals and the total deal value. Heading towards 2022, PharmaShots is providing insightful data by performing the analysis of 2021. So don't forget to check out our Deal Maker of the Year 2021 (pharmashots.com) by the total number of deals.

Top Deal of Roche

Roche and Recursion Collaborated to Launch a ~$12B AI Drug a Discovery Effort

Roche and Genentech will leverage the Recursion Operating System, an integrated, multi-faceted system for generating, analysing and deriving insight from massive proprietary biological and chemical datasets. The OS brings together wet-lab and dry-lab biology at scale to further industrialize and digitize drug discovery, will be deployed to phonemically capture chemical and genetic perturbations in neuroscience-related cell types and select cancer cell lines.

As per the agreement, Roche paid $150M up front and may pay up to $300M in payments toward the achievement of development, commercialization, and net sales milestones for each of up to 40 programs and will also pay royalties for the same.

Adaptimmune and Genentech Collaborated for Allogeneic Cell Therapies Development

Adaptimmune has signed a strategic partnership and licence agreement with Roche Group member, Genentech, to develop and market allogeneic cell therapies for the treatment of multiple cancer indications. Roche's Genentech unit provided ~$150M up front to Adaptimmune to develop and commercialize allogeneic cell therapies for up to five shared cancer targets. The deal also includes development of a personalized allogeneic T-cell therapies. The alliance includes another ~$150M over the next five years for additional payments and development, unless the agreement is terminated. The transaction could exceed ~$3B. Additionally, Adaptimmune can opt into a 50/50 US profit/cost share for the off-the-shelf products.

Roche and Shape Therapeutic Entered into a ~$3B Gene Therapy Pact Targeting Alzheimer’s, Parkinson’s and Rare Diseases

Roche teamed up with Shape Therapeutics on next-generation gene therapies for Alzheimer’s, Parkinson’s and rare diseases in a deal that could exceed $3B. Shape will use its RNA-editing platform to identify development candidates against multiple targets whereas Roche will be responsible for the development and worldwide commercialization of any potential products that emerge from the collaboration. The companies only mentioned a total deal value of $3B, which includes an upfront payment and milestone payments if development, regulatory and sales goals are met.

Roche Acquired GenMark Diagnostics for $1.8B

Roche acquired GenMark at $24.05 per share in an all-cash transaction, totalling approximately $1.8B on a fully diluted basis. That represents a premium of ~43% to GenMark’s unaffected closing share price on Feb 10, 2021. Roche completed the acquisition of GenMark on Apr 22, 2021. Following completion of the acquisition, GenMark will become a wholly owned subsidiary of Roche, and GenMark's shares will cease to be traded on the NASDAQ stock market.

Source: https://www.roche.com/investors/updates/inv-update-2021-04-22.htm

Pieris and Roche Signed a $1.4B Respiratory and Ophthalmology Alliance

Pieris and Roche’s Genentech partnered in a multi-program research and licence agreement worth up to ~$1.42B to discover, develop and commercialize respiratory and ophthalmology therapies.

As per the collaboration, Pieris received ~$20M up front and is eligible for additional payments of up to ~$1.4B across multiple programs on meeting milestones, and tiered royalties for marketed programs.

Pieris is responsible for discovery research and early preclinical development of the programs, and Genentech is responsible for IND-enabling activities, clinical development, and commercialization of those programs. Genentech has an option to select additional targets in return for an option exercise payment. The collaboration did not include any of Pieris' internal programs.

Related Post: Deal Maker of the Year 2021 (Part 01)