Deal Maker of the Year 2021 (Part 01)

Shots:

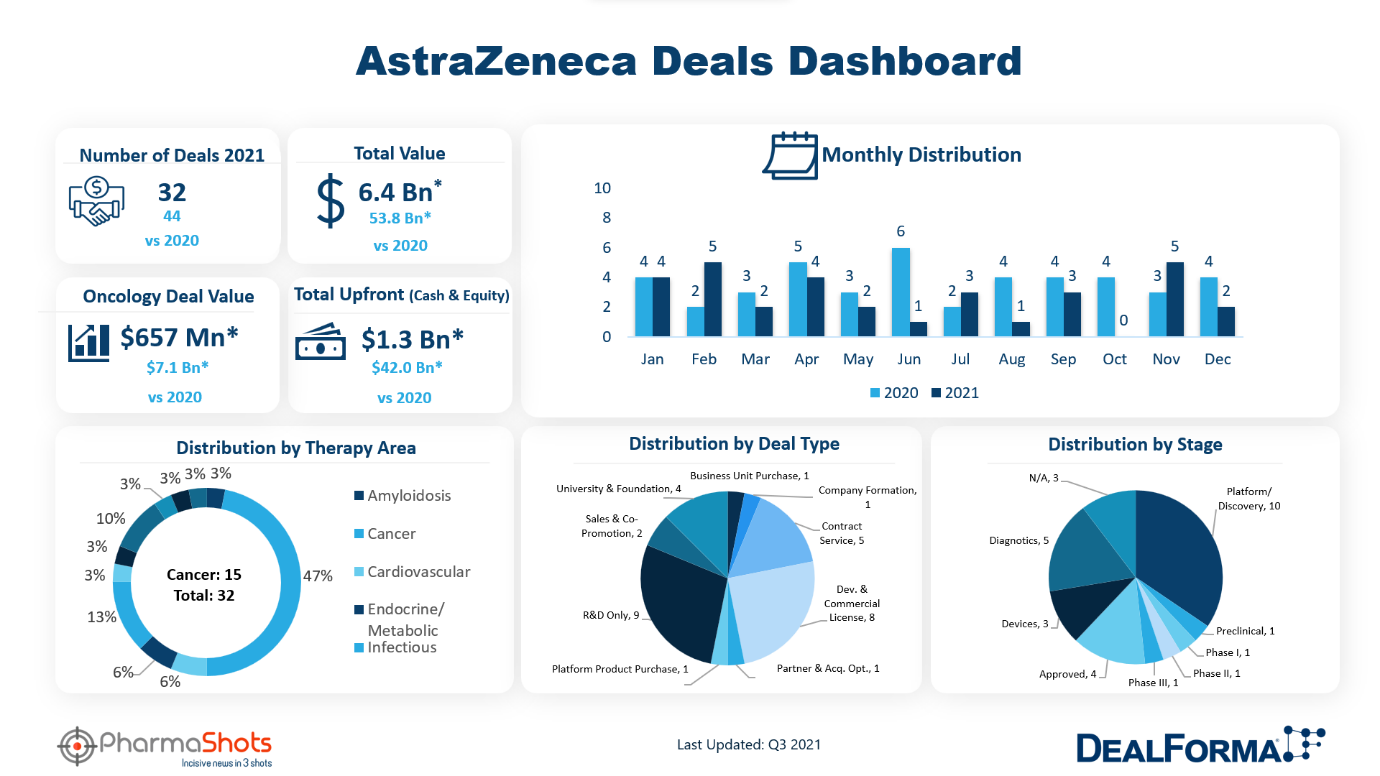

- AstraZeneca and Roche were the top dealmakers completed 33 deals with multiple pharma and biotech companies and universities for a total deal value of $6.2B & $25.83B

- The highest value deal was AstraZeneca’s partnership with Ionis for the development and commercialization of Eplontersen signed on Dec. 7, 2021.

- Merck and Pfizer are among the top dealmakers as well. The team at PharmaShots leverages the data from DealForma and provides the insightful data for Deal Maker of the Year

Summary

Dealmaking across all aspects of healthcare continued to advance and set new records in 2021. Biopharma therapeutics and discovery platform companies led the way and MedTech activity remains substantially above its pre-pandemic level. Biopharma companies developing cancer therapies were the busiest signing deals to develop biologics and small molecule drugs. Considering the trends in the dealmaking in the healthcare sector, our team at PharmaShots worked on the Deal Maker of the Year, 2021 by leveraging the data from DealForma. On track for the deal maker of the year, Roche, Pfizer, AstraZeneca, and Merck were the frontrunners. Roche and AstraZeneca are at the top of the list when it comes to the number of agreements in 2021. PharmaShots has covered AstraZeneca in depth*.

AstraZeneca carried out 33 deals in 2021 which include R&D deals, contract services, development & commercialization agreements, sales, and promotion, etc. with a total announced deal value of $6.2B. Out of the total 33 deals, the maximum deals signed are R&D deals (N=9), followed by development & commercialization deals (N=8). AstraZeneca also signed 4 university partnerships, 5 contract services agreements, and 1 business unit purchase. Moreover, there are 2 sale/promotion agreements and 1 product purchase deal. AstraZeneca’s focused therapeutic area is oncology with an emphasis on lung cancer, prostate cancer, bladder cancer, and solid tumors. Other centered therapeutic areas are renal, endocrine, cardiovascular, and infectious.

As mentioned, Roche and Pfizer competed for top deal maker with 32 and 29 deals along with $25B and $14B in total announced deal value, respectively. Heading towards 2022, PharmaShots is providing insightful data by performing the analysis of 2021. Stay tuned with us for Roche’s coverage.

Top Deals for AstraZeneca

Ionis and AstraZeneca to Develop and Commercialize Eplontersen:

Ionis partnered with AstraZeneca in a territory-specific development, commercial, and medical affairs cost-sharing agreement for eplontersen, an investigational antisense medicine for the treatment of transthyretin amyloidosis. AstraZeneca gained an exclusive license for eplontersen outside the US, except in certain countries in Latin America. The two companies will jointly commercialize the ATTR drug in the US. AstraZeneca provided Ionis with $200M upfront with an additional ~$485M in development and approval milestones. Ionis will be eligible for royalties in the range of low double-digits to mid-20s percentages depending on the region. When royalties from sales are considered, the partnership could bring up to $2.9B to Ionis. hATTR with polyneuropathy is the first indication for which the companies will seek regulatory approval for eplontersen, and by the end of 2022 the company’s plans to file the NDA with the US FDA. The companies are closing out the agreement on Dec 29, 2021, with an anticipation that this deal will provide faster and deeper market penetration into the growing global TTR amyloidosis market.

AstraZeneca to Divest its 26.7% Viela Shareholding

AstraZeneca has agreed to divest its 26.7% stake in Viela Bio as part of the latter’s proposed acquisition by Horizon Therapeutics. Under the agreement, AstraZeneca has received cash proceeds and a profit of $760-$780M. The company completed the divestment on Mar 17, 2021. Later, Horizon Therapeutics announced that it agreed to buy Viela Bio for ~$3.1B.

AstraZeneca to Acquire Caelum Biosciences:

AstraZeneca took full control of Caelum Biosciences in a deal worth up to $500M to sharpen its focus on rare disease drugs (CAEL-101) following its purchase of Alexion Pharmaceuticals. AstraZeneca’s Alexion has exercised its option to acquire all remaining equity in Caelum and paid $150M up front at closing on Oct 5, 2021. Furthermore, Caelum stakeholders are eligible to receive further potential payments which would total to up to $350M on meeting regulatory and commercial milestones. Alexion took a minority stake in Caelum in 2019 for $60M. The deal gives AstraZeneca access to another potentially lucrative rare disease drug that is in late-stage trials and has a fast-track status for regulatory review in the US.

F-star Therapeutics Signed an Exclusive Licensing Agreement with AstraZeneca for Novel STING Inhibitors

The companies partnered to research, develop, and commercialize next-generation Stimulator of Interferon Genes (STING) inhibitor compounds. Under the agreement, AstraZeneca granted exclusive access to F-star’s novel preclinical STING inhibitors and will be responsible for all future research, development, and commercialization of the STING inhibitor compounds. F-star retains rights to all STING agonists currently in clinical development for cancer. AstraZeneca paid $12M upfront and may pay up to ~$300M in development and sales milestone along with single-digit percentage royalty payments. Payments received by F-star are subject to a CVR 2, under which a percentage will be payable to stockholders of F-star that were previously stockholders of Spring Bank prior to the business combination between F-star and Spring Bank.

AstraZeneca to Transfer Eklira, Duaklir Global Rights to Covis Pharma for $270M

AstraZeneca signed an agreement to transfer global rights to respiratory drugs, Eklira and Duaklir to Covis Pharma in a deal valued at $270M. The two medicines Eklira (aclidinium bromide) known as Tudorza in the US, and Duaklir (aclidinium bromide/formoterol) are delivered via a breath-actuated multi-dose dry powder inhaler, Genuair. Both drugs are used to treat patients with chronic obstructive pulmonary disease (COPD). In 2018, Covis Pharma bought the rights to the respiratory drugs Alvesco, Omnaris, and Zetonna from AstraZeneca.

*Disclaimer: PharmaShots has not included clinical trial agreements and older deals with only milestone payments in 2021.

#Overall deal value is higher than mentioned as AZ has ~20 undisclosed deals.