J.P. Morgan Healthcare Conference Special: Dealmaker of the Year 2025 (Part 02)

Shots:

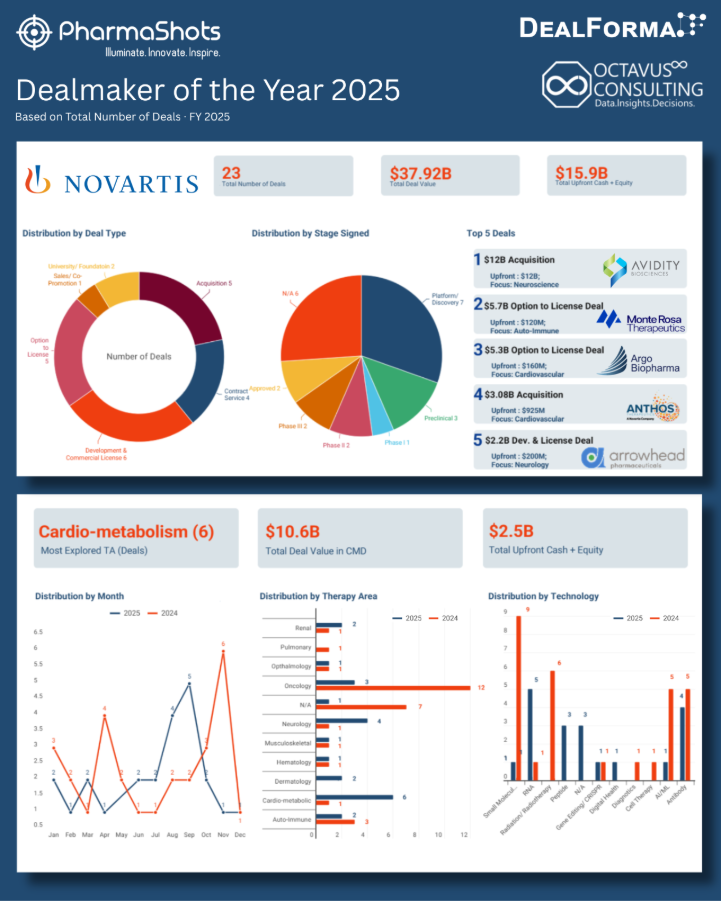

- Novartis led biopharma dealmaking in 2025, executing 23 transactions worth $37.92B with a disciplined, high-impact strategy that balanced scale, science, and strategic fit

- Dealmaking was spread across high-conviction areas; neuroscience, cardiovascular disease, immunology, and RNA platforms, combining transformational acquisitions with flexible licensing partnerships to build a future-ready pipeline

- Standout transactions (Avidity, Monte Rosa, Argo, Anthos, Arrowhead) reinforced Novartis’ leadership in next-generation modalities, earning it clear recognition as Dealmaker of the Year 2025 and setting a strong benchmark for 2026

In 2025, Novartis firmly established itself as the Dealmaker of the Year based on total deal value, strategic coherence, and portfolio-shaping impact. Over the course of the year, Novartis executed 23 transactions with an aggregate value of $37.92B, supported by $15.9B in upfront cash and equity, highlighting a bold yet methodical approach to external innovation.

Rather than relying on a single transformational acquisition, Novartis deployed capital across multiple high-conviction opportunities, spanning neuroscience, cardiovascular disease, immunology, and RNA-based platforms. The result is a diversified, future-ready pipeline designed to deliver both near-term value and long-term growth.

Why Novartis Stood Out in 2025

Novartis’ 2025 dealmaking strategy reflects a clear set of priorities:

- Strengthening the late-stage and near-commercial pipeline to mitigate medium-term LOE exposure

- Gaining access to next-generation platforms such as AOCs, targeted protein degradation, and siRNA

- Focusing on high-unmet-need indications with durable commercial potential

This balanced approach positions Novartis not just as an active dealmaker, but as a disciplined architect of long-term portfolio value.

Key Transactions Driving Dealmaker of the Year Recognition

Acquisition of Avidity Biosciences ($12B)

The acquisition of Avidity Biosciences marks Novartis’ most impactful transaction of 2025, significantly advancing its neuroscience ambitions.

- Novartis gains access to Avidity’s Antibody Oligonucleotide Conjugates (AOCs) platform and three late-stage neuromuscular programs

- Transaction terms include $72 per share, valuing Avidity at approximately $12B (enterprise value ~$11B)

- Deal closing is expected in H1’26

Structural Highlights

- Early-stage precision cardiology assets will be transferred to SpinCo, a wholly owned subsidiary of Avidity

- Shareholders will receive 1 SpinCo share per 10 Avidity shares and/or a potential cash distribution

- Novartis retains a right of first negotiation for select SpinCo assets

Takeaway: This acquisition underscores Novartis’ conviction in advanced RNA delivery technologies and its intent to build durable leadership in neuroscience.

Licensing Collaboration with Monte Rosa Therapeutics ($5.7B)

Novartis partnered with Monte Rosa Therapeutics to develop novel targeted protein degraders for immune-mediated diseases.

- Exclusive license to an undisclosed discovery target

- Options to license two additional preclinical immunology programs

- Powered by Monte Rosa’s QuEEN discovery engine

Deal Economics

- $120M upfront payment

- Option maintenance fees and preclinical milestones

- Development, regulatory, and sales milestones across programs

- Tiered net-sales royalties ranging from high single to low double digits

Takeaway: The collaboration reflects Novartis’ preference for platform-driven innovation with built-in flexibility and capital efficiency.

Strategic Licensing Deal with Argo Biopharma ($5.3B)

Novartis expanded its cardiovascular footprint through a multi-asset partnership with Argo Biopharma.

- Options to license ex-China rights to two discovery-stage assets for severe hypertriglyceridemia and mixed dyslipidemia

- First negotiation rights for BW-00112 (ANGPTL3), a Phase II asset

- Reciprocal P&L-sharing structure for a hepatic siRNA program expected to enter Phase I in 2026

Financial Structure

- $160M upfront

- Approximately $5.2B in milestones and option payments

- Tiered royalties

- Novartis signaled non-binding intent to participate in Argo’s next equity financing round

Takeaway: This deal highlights Novartis’ increasingly nuanced approach to regional rights, risk-sharing, and RNA-based cardiovascular innovation.

Acquisition of Anthos Therapeutics ($3.08B)

Novartis’ acquisition of Anthos Therapeutics strengthens its cardiovascular portfolio with a differentiated late-stage asset.

- Anthos was originally launched by Blackstone Life Sciences and Novartis in 2019

- Total consideration of approximately $3.1B, including $925M upfront and up to $2.15B in milestones

- Transaction closed/expected to close in H1’25

Lead Asset: Abelacimab

- Demonstrated reduced bleeding risk versus standard oral anticoagulants in the Phase II AZALEA trial

- Currently being evaluated in three Phase III trials: LILAC-TIMI 76, ASTER, and MAGNOLIA

Takeaway: Abelacimab positions Novartis as a potential leader in next-generation anticoagulation therapies with improved safety profiles.

Development & Commercialization Agreement with Arrowhead Pharmaceuticals ($2.2B)

Novartis secured exclusive global rights to ARO-SNCA, an RNAi therapy targeting synucleinopathies, including Parkinson’s disease.

- Asset leverages Arrowhead’s TRiM platform for targeted subcutaneous delivery

- $200M upfront payment

- Up to $2.0B in development, regulatory, and sales milestones

- Tiered royalties reaching low double digits

- Closing anticipated in H2’25

Under the collaboration, Arrowhead will conduct preclinical activities through CTA filings, after which Novartis will assume responsibility for development, manufacturing, medical affairs, and commercialization.

Takeaway: The agreement reinforces Novartis’ long-term commitment to RNA therapeutics and neurodegenerative disease leadership.

Key Takeaways

- Novartis didn’t just stay active in 2025, it executed with clear intent and long-term vision

- The deal strategy was firmly rooted in strong science, differentiated platforms, and clinically mature assets

- A smart blend of transformational acquisitions and selective licensing partnerships helped build depth without overconcentration

- The outcome is a robust, future-ready pipeline positioned to fuel sustained innovation and growth

- With leadership in total deal value, high-quality assets, and tight strategic alignment, Novartis stood apart from peers

- All factors considered, Novartis rightfully earns the title of Dealmaker of the Year 2025, setting a compelling benchmark for biopharma dealmaking as the industry heads into 2026

About DealForma:

DealForma maintains the most comprehensive database for biopharma deal benchmarking in a modern platform that combines highly curated licensing, venture, and M&A data, an intuitive interface, and biopharma-specific categories for indications, modalities, targets, and stages of drug development. The DealForma database is trusted by biotech, pharma, investment banks, and advisory firms for accurate data on industry activity.

About Octavus Consulting:

Octavus is a boutique consulting company, engaged in comprehensive business research, market intelligence, market research and data analytics by providing support and outsourcing solutions to bio-pharma, medtech, diagnostics, digital health companies and healthcare start-ups.

Related Post: J.P. Morgan Special: Dealmaker of the Year 2024 (Part 02)