J.P. Morgan Healthcare Conference Special: Dealmaker of the Year 2025 (Part 01)

Shots:

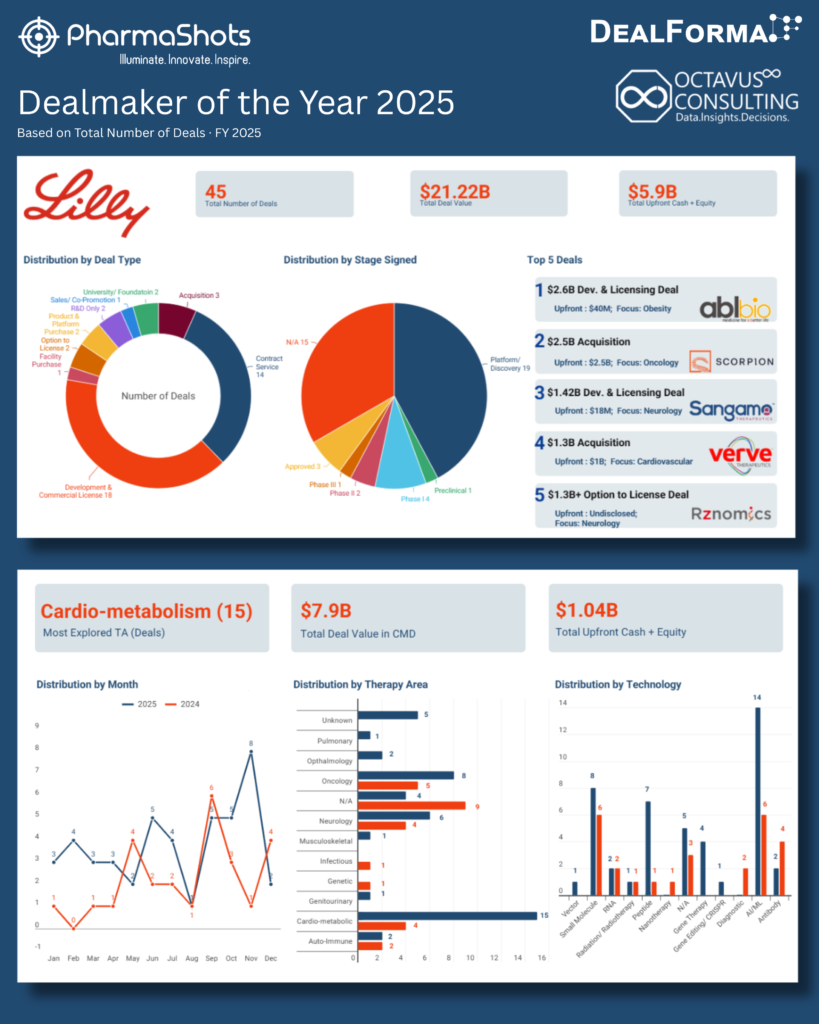

- Lilly leads with precision and purpose with 45 deals totaling $21.22B in 2025, focusing on platform-driven, science-led partnerships across oncology, gene therapy, RNA editing, and AI-enabled discovery while building durable innovation engines rather than chasing short-term wins

- Strategic dealmaking over sheer volume is evident in partnerships like precision oncology with Scorpion Therapeutics and CNS delivery with Sangamo, structured to balance risk, retain long-term optionality, and scale across multiple indications, showing that deal design is as critical as the assets themselves

- Platforms and enabling technologies provide a competitive edge as Lilly emphasizes antibodies, gene editing, RNA therapies, and delivery platforms with platform-first strategies, early-stage science with scalable potential, and flexible deal structures, setting a new benchmark for disciplined, forward-looking biopharma dealmaking

For decades, the J.P. Morgan Healthcare Conference has served as the definitive barometer of biopharma dealmaking. In 2025, it delivered a clear signal: strategic, platform-driven, and science-led partnerships have firmly reclaimed center stage.

Against this backdrop, Eli Lilly emerged as the standout dealmaker of the year, executing 45 transactions valued at $21.22 billion. While the headline numbers are striking, the deeper story lies in the precision of Lilly’s capital deployment. Spanning oncology, gene therapy, RNA editing, and AI-enabled discovery, these deals reflect a company building durable innovation engines rather than chasing near-term wins.

Lilly: The Power Player

Lilly’s 2025 deal activity resembles a deliberate portfolio construction strategy, not a volume-driven acquisition spree. Each partnership reinforces a consistent strategic ambition: to strengthen scientific leadership while expanding optionality across high-impact therapeutic and technological platforms. The following five transactions illustrate how Lilly systematically reinforced its pipeline.

Lilly & ABL Bio: Expanding the Oncology Frontier

One of the most strategically layered transactions of the year was Lilly’s ~$2.6 billion license, research, and collaboration agreement with ABL Bio, supported by $55 million in funding ($40 million upfront and $15 million in equity).

The partnership advances multiple therapeutic candidates leveraging ABL Bio’s Grabody platform, spanning bispecific antibodies, next-generation ADCs, and immuno-oncology combinations. Notably, the collaboration extends into obesity and muscle disorders, underscoring Lilly’s intent to deploy antibody innovation beyond traditional oncology applications.

Takeaway: This is platform-centric investing, deploy once, scale across multiple high-value indications.

Lilly & Scorpion Therapeutics: Precision Oncology with Structural Flexibility

Lilly’s ~$2.5 billion acquisition of Scorpion Therapeutics reinforces its conviction in precision oncology, particularly PI3Kα inhibition. The lead asset, STX-478, is an oral PI3Kα inhibitor currently in Phase I/II trials for HR-positive breast cancer and other advanced solid tumors.

Equally notable is the transaction structure. Scorpion will spin out into a separate entity housing non-PI3K assets, with Lilly retaining a minority stake an approach that enables focus on priority assets while preserving long-term innovation potential.

Takeaway: Strategic deal design can be as critical as asset selection.

Lilly & Sangamo: Advancing CNS Drug Delivery

Drug delivery to the central nervous system remains one of biopharma’s most formidable challenges. Lilly’s partnership with Sangamo addresses this directly through STAC-BBB, a neurotropic AAV capsid designed to cross the blood–brain barrier.

Under the agreement, Lilly receives a global exclusive license for one CNS target, with options for up to four additional targets. The deal includes $18 million upfront and up to $1.4 billion in milestones, along with tiered royalties. STAC-BBB’s demonstrated CNS penetration in nonhuman primates positions it as a potentially transformative delivery platform.

Takeaway: Delivery technologies are increasingly strategic assets, not supporting tools.

Lilly & Verve Therapeutics: Gene Editing at Cardiovascular Scale

With its ~$1 billion acquisition of Verve Therapeutics, Lilly brings in vivo gene editing into its cardiovascular portfolio. The lead program, VERVE-102, targets PCSK9 and is being evaluated in a Phase Ib trial for ASCVD, having already received Fast Track Designation from the US FDA.

The inclusion of a contingent value right (CVR) tied to future clinical milestones reflects Lilly’s preference for risk-aligned, performance-based deal structures.

Takeaway: Gene editing is transitioning from experimental science to a core pillar of chronic disease strategy.

Lilly & Rznomics: RNA Editing for Rare Diseases

Completing Lilly’s multi-modality expansion is its partnership with Rznomics, focused on RNA-editing therapies for inherited hearing loss. If all options are exercised, the transaction could exceed $1.3 billion, with Lilly assuming responsibility for late-stage development and global commercialization.

Takeaway: Precision medicine is extending beyond oncology into rare and underserved indications.

The Dealmaker’s Playbook

What ultimately distinguishes Lilly’s 2025 dealmaking is not sheer volume, but strategic coherence. Across its 45 transactions, several defining principles emerge:

- Platform-first strategies over single-asset acquisitions

- Early-stage science paired with long-term scalability

- Modal diversity, spanning small molecules, antibodies, gene therapy, and RNA editing

- Flexible deal structures designed to balance risk and reward

Key Takeaways

- Scale has returned to dealmaking—but with precision and intent

- Platforms, rather than individual assets, are driving valuation and partnerships

- Delivery and enabling technologies are becoming decisive competitive advantages

- Lilly has set a new benchmark for disciplined, forward-looking biopharma dealmaking

With $21.22 billion deployed across 45 deals, Eli Lilly has not only earned recognition as Dealmaker of the Year 2025, but also established a blueprint for how modern biopharma leaders can navigate complexity with clarity, conviction, and strategic discipline.

Coming up in Part 02: a closer look at other leading dealmakers, cross-sector collaborations, and the trends reshaping healthcare partnerships in 2025.

About DealForma:

DealForma maintains the most comprehensive database for biopharma deal benchmarking in a modern platform that combines highly curated licensing, venture, and M&A data, an intuitive interface, and biopharma-specific categories for indications, modalities, targets, and stages of drug development. The DealForma database is trusted by biotech, pharma, investment banks, and advisory firms for accurate data on industry activity.

About Octavus Consulting:

Octavus is a boutique consulting company, engaged in comprehensive business research, market intelligence, market research and data analytics by providing support and outsourcing solutions to bio-pharma, medtech, diagnostics, digital health companies and healthcare start-ups.

Related Posts: J.P. Morgan Healthcare Conference Special: Dealmaker of the Year 2024 (Part 01)