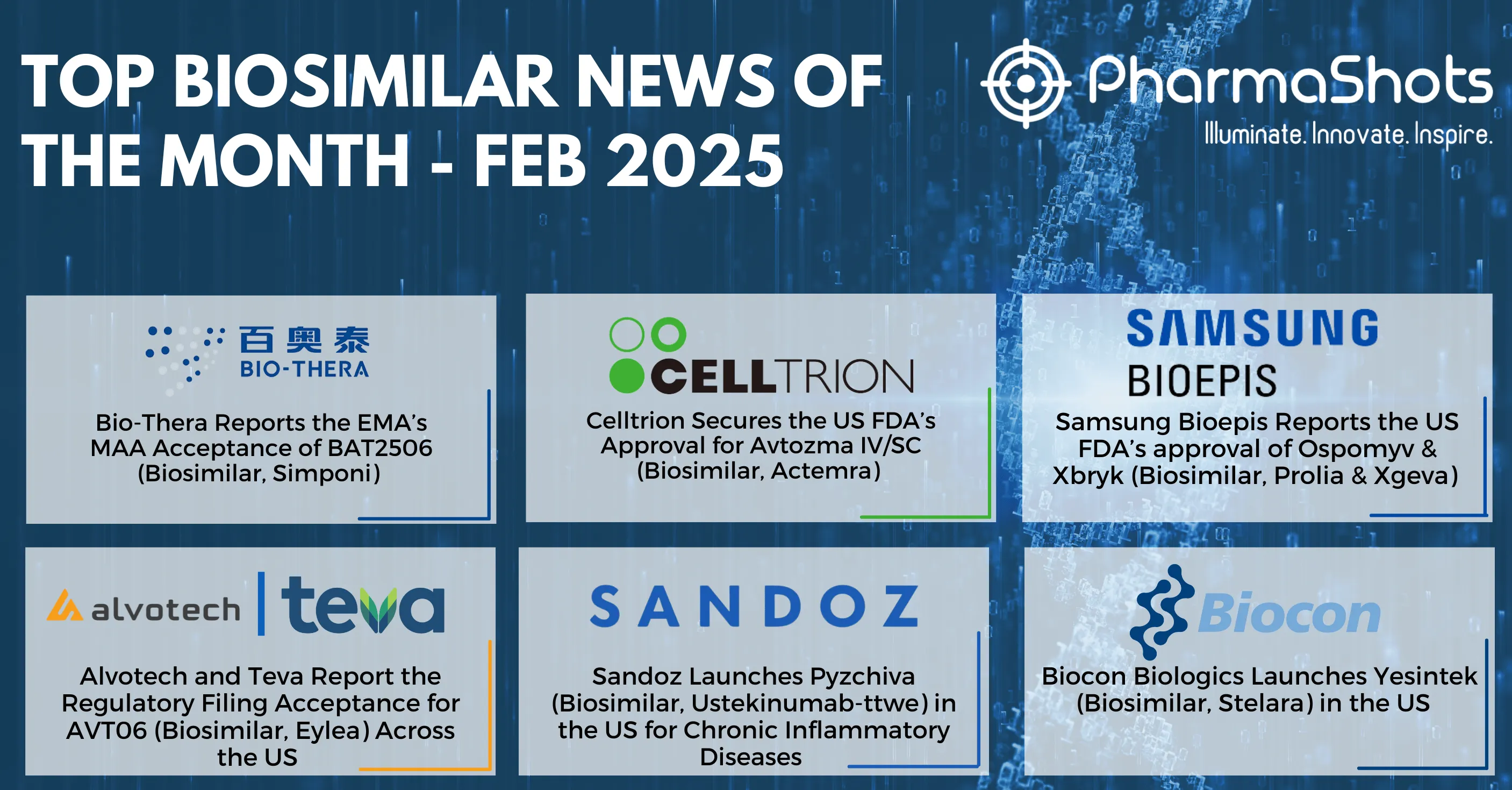

Insights+: An Analysis of Biopharma Companies Growth in Last 20 Years (1999-2018)

In the last 20 years the global Biopharma space has changed a lot with ups and downs of companies and their growth. This analysis has found the multiple acquisitions and mergers along with the launch of several blockbusters leading to jump in growth and revenue of numerous companies. Pfizer acquired Warner-Lambert in 2000 to gain rights of Lipitor, which generated around 25% of Pfizer's total revenue. In 2001, Bayer reported massive decline in its revenue and its shares decreased, following the global withdrawal of its cholesterol-lowering drug Lipobay causing side effects of muscle weakness in patients. In 2002, merger of Pfizer and Pharmacia resulted in growth of 40% in pharma and 43% in animal health. Abbott also showed remarkable performance in 2007 and reflected sales growth of 15.3%, with its blockbuster product Humira (adalimumab) with annual sales of $3B. There was a sudden decline in the revenue of Pfizer due to patent expiry and generic launches of Lipitor in 2011, led to decline of $14B of net sales in 2012. Our team at PharmaShots has summarized and complied the key events in the Biopharma world for the last 20 years along with the video of growth race in Biopharma companies.

https://public.flourish.studio/visualisation/401448/

1998

- In 1998, Bayer topped among the competitors with the revenue of $32B. Bayer's genetically engineered drug, Kogenate achieved the growth of 30% and its anti-infective drug Ciprobay showed strong sales performance, while its lipid-lowering agent Lipobay which failed to achieve the expectations

- Johnson & Johnson strengthened its medical device division with the acquisition of DePuy and women's health segment by acquiring Biopsys and Gynecare

- Novartis recorded a substantial improvement in the net earnings of $23B, its leading antifungal drug Lamisil showed a significant performance in the US and Japan and its flagship product Sandimmun maintained its status as the gold standard for transplantation

- Pfizer's revenue was increased by 14% with the launch of Viagra, which generated the sales of $0.6B

- Abbott's Prevacid, (developed through its JV with Takeda) generated revenue of $1.3B

1999

- Bayer continued its leadership in life sciences sector despite of their group sales dipped by 2.6%, but the demand for its Lipid lowering drug Lipobay and a CVS drug Adalat, generated strong sales in the US market. Bayer acquired Chiron Diagnostics to expand its diagnostics business

- Novartis Sandimmuns, the top selling drug increased the sales by 5% and their top 10 products increased the sales to 12% and lose the sales by 13% due to competition and generic products. Novartis generic business showed significant growth in this year

- European pharma companies Zeneca and Astra merged to create seventh largest pharmaceutical company with a market leadership in oncology and anesthesia

2000

- Johnson & Johnson marked an increase in its revenue as compared with the previous year with $29B.

- Pfizer achieved a global revenue of $26B with 8% growth over the previous year and their pharmaceutical revenue increased to 18%. Its cardiovascular division gained a revenue of $10.3B. Lipitor was the largest selling medicine in the world for lipid lowering and generated a revenue of $5B. Eight out of the top 10 drugs achieved more than $1B sales. Pfizer's Animal Health was the second largest supplier of animal medicines. In 2000, Pfizer merged with Warner-Lambert

- Novartis managed to achieve a revenue of $21.8B and acquired Wesley Jessen as well as acquired the antiviral products Famvir (famciclovir) and Vectavir/Denavir (penciclovir) from SmithKline Beecham

- In the first quarter of the year, Glaxo Wellcome and SmithKline Beecham completed their merger to create the second largest pharmaceutical company in the world

2001

- Johnson & Johnson acquired Alza Corporation to strengthen its drug delivery business. Johnson's Recombinant Erythropoietins drug, Procrit achieved 10.4% of the total company's revenue

- Novartis recorded double digit growth in the group sales. Novartis US pharmaceutical sales increased by 24%

- Pfizer's alliance product Celebrex generated the revenue of $1B

- 2001 was a difficult year for Bayer with the voluntary withdrawal of their blockbuster drug Lipobay due to its adverse effects in patients post marketing

- Abbott acquired the pharmaceutical business of BASF including operations of Knoll Pharmaceuticals

- BMS Acquired DuPont for $7.8B in the fourth quarter of 2001 to strengthen its pharmaceutical business

2002

- Johnson & Johnson emerged as a leader in the healthcare sector with the recorded sales of $36.3B representing 12.3% growth from 2001. The company acquired a specialty pharmaceutical company OraPharma and Belgium based firm Tibotec-Virco

- Novartis strengthened its animal health business through the acquisition of Grand Laboratories and ImmTech Biologics. Additionally, Novartis acquired a generics company Lek and divested its food and beverage business to Associated British Foods

- For Bayer, 2002 was considered as the year for portfolio changes and realignment of corporate structure, their group business declined by 2% and continuing operations dipped by 1%

- During the third quarter of the year, Amgen acquired Immunex to add blockbuster drugs Epogen, Neupogen and Enbrel to its portfolio

2003

- Pfizer and Pharmacia merged to create a globally fastest growing and the largest pharmaceutical company in the world. Inclusion of Pharmacia's product and strong performance Pfizer's product boosted to 40% revenue in pharmaceuticals and 43% in animal health

- Johnson & Johnson generated the revenue of $41.9B which rose by 15.3% over the previous year. Additionally, Johnson's acquired Orquest and Link Spine Group to strengthen its orthopedics and spine business. Johnson introduced CYPHER Sirolimus-eluting Stent, which will be used by over half million patients globally

- Bayer significantly improved the overall performance in 2003 following the decline in the company's performance in the past two years. Bayer recorded $2.9M net loss in revenue due to the changes and realignment of the portfolio

- Novartis' sales increased by 19% due to the dynamic growth of its generic business and demand of the generic version of Augmentin and AmoxC. Additionally, Novartis merged product portfolio of 15 generic units and named it as Sandoz. Novartis acquired 51% interest in Dienic Pharmaceuticals

- Abbott achieved the sales of $17B which represented growth of 11.3% than the past year. Abbott acquired Spinal Concepts (Spinal fixation maker), Jomed (cardiovascular device developer), i-STAT (POC Diagnostic manufacturer), & ZonePrfect Nutrition (Nutritional Business)

- During the third quarter of the year, Amgen acquired Immunex to add blockbuster drugs Epogen, Neupogen and Enbrel to its portfolio

- In November, Biogen merged with Idec to create a biotechnology leader Biogen Idec

2004

- Pfizer recorded the revenue of $52.5B with a growth of 17% from the previous year with cost savings and synergies from the prior acquisition of Pharmacia. Lipitor became the pharmaceutical industries' first $10B product

- Johnson & Johnson achieved the two full decades of consecutive double-digit earnings. Company's top eight products generated a revenue of more than $1B. Its subsidiary, DePuy's CHARITE Artificial Disc for degenerative disc disease was the first device to be approved by the US FDA

- Bayer strengthened its consumer health business with the acquisition of Roche's OTC business. Decline in the sales of Cipro following the patent expiry and pharmaceutical division dipped by 12.9%. Erectile dysfunction drug Levitra rose by 34% and Avalox continued to advance in a highly competitive environment. MaterialScience subgroup moved ahead effectively in 2004, rising by 15.3%

- Abbott spun off its hospital product business into an independent company Hospira. Additionally, Abbott's breakthrough drug Humira achieved global sales of more than $0.8B

- Sanofi-Synthelabo merged with Aventis in second quarter of 2014, to create world's third largest pharmaceutical group Sanofi-Aventis

2005

- Pfizer's revenue decreased by 2% from last year due to the loss of exclusivity of Diflucan, Neurontin and Accupril/Accuretic and Zithromax in the US and suspension of Bextra sales & label changes for Celebrex. Pfizer acquired Vicuron and Idun to strengthen its pharmaceutical business

- Johnson & Johnson achieved worldwide sales of $50.5B with a growth rate of 7%. Cordis franchise was a key contributor to the segment results which reported sales of $4B. Johnson's acquired TransForm Pharmaceuticals, Hand Innovations (Medical Device Manufacturer), Animas Corporation (Insulin Delivery), Closure Medical Corporation (Biosurgical), Peninsula Pharmaceuticals (Antibiotics Developer)

- Novartis acquired two generic companies Hexal and Eon Labs and integrated with Sandoz. Additionally, Novartis granted exclusive marketing rights to Meda for Cibacen and Cibadrex in major EU markets for $0.13B

- Bayer sales rose by 18%, attributable mainly to the consumer health business acquired from Roche

- Abbott achieved $1.4B globally by sales of Humira

2006

- Johnson and Johnson recorded a global sales of $53.3B with the growth rate of 5.6% as compared to the revenue in 2005. Johnson's DePay strengthened its portfolio by acquiring Hand Innovations, Future Medical Systems and OrthoMedics

- Novartis generated consolidated net sales of $36B. Novartis acquired Chiron, NeuTech Pharma and diversified its Nutrition & Sante business

- Bayer reinforced the pharmaceutical business with the acquisition of Schering

- Abbott registered a substantial growth in 2006. Its flagship product Humira achieved $2B global revenue. Abbott acquired Kos Pharmaceuticals and Guidant's vascular business and launched a new division, Abbott Nutrition International

2007

- Johnson and Johnson achieved a remarkable performance in 2007, their consumer health business improved drastically with 48.3% growth in revenue following the addition of Pfizer's Consumer Health business in the previous year. Johnson's acquired drug delivery technology maker, Conor Medsystems

- Pfizer reflected a slight growth as compared to the previous year revenues. Pfizer's three portfolio drugs are listed in world's 25 bestselling medicines. Additionally, Pfizer acquired BioRexis to strengthen diabetes portfolio and Embrex for animal health business

- Novartis reported a stable growth as compared to the 2006 revenue, three of its pharmaceutical products Lotrel, Lamisil and Trileptal were negatively affected due to generic competition. Novartis divested its Medical Nutrition Business Unit and Gerber Business Unit to Nestle. Sandoz contributed 19% of the group's sales in 2007

- Bayer achieved a rapid growth by a rise in 12% following its portfolio changes and the acquisition of Schering

- Abbott's performance in 2007 reflected a sales growth of 15.3%. Its lead product Humira achieved $3B and TriCor generated the revenue of $1B

- AstraZeneca acquired MedImmune for $15.6B to strengthen its biologics capabilities

2008

- Johnson and Johnson marked an inclination in its sales revenue by 4.3% and its consumer segment achieved 10.8% over the previous year. In 2008, Johnson acquired tissue sealing system developer, SurgRx

- Pfizer's sales revenue depicted a steady sale and its pharmaceutical segment increased after the acquisitions of Serenex, Encysive Pharmaceuticals, CovX and Coley Pharmaceuticals

- Novartis reported the revenue of $41.4B, its pharmaceutical division faced a revenue loss of $2.6B as a result of generic competition. Novartis acquired 25% stake in Alcon and acquired majority ownership in Speedel

- Bayer raised its sales by 4.4% and its Women's Healthcare business increased by 9.2%

- Abbott achieved a substantial double-digit growth in 2008 with an inclined sale of 13.9%.

2009

- 2009 was a challenging year for the multinational companies due to the recession and currency fluctuations

- Johnson and Johnson's performance graph declined by 2.9% for the first time after 76 years. Despite a challenging year, Johnson's acquired Cougar and Elan

- Pfizer's 2009 performance was significant as compared to 2008 with the addition of Wyeth. In 2009, none of the Pfizer's products achieved the sales of $1B

- Regardless of the challenging year Abbott's revenue showed a progressive growth, but faced a negative impact from the lower sales of Depakote

- Roche acquired Genentech to broaden its bio-pharmaceutical business

2010

- Pfizer expanded its revenue in an exponential manner with an upsurge of 36% due to the inclusion of Wyeth products. Additionally, it acquired FoldRx Pharmaceuticals

- In the wake of economic downturn, Johnson and Johnson experienced a steady business with the decrease of 1.3% sales globally, but strong progress in emerging markets

- Novartis recorded a strong growth in all its business units with the rise in sales by 14%. Sandoz achieved double-digit growth with a revenue of $8.5B, its consumer health business overcame the recession by increasing the net sales by 7%

- Abbott delivered a strong performance of $35.2B and completed an agreement with Zydus Cadila for 24 branded generic pharmaceutical products in 15 emerging markets

- Abbott acquired Solvay Pharmaceuticals and Piramal's Healthcare Solution's business

- Bayer raised its group sales by 12.6% and its lead product Xarelto had a peak sales potential of more than $2.14B

2011

- Pfizer stayed in a steady revenue position as compared to its previous year's growth, it also acquired King Pharmaceuticals and Excaliard plus consumer healthcare business of Ferrosan and divested its Capsugel business

- Johnson's Medical Device and Diagnostics business unit achieved the sales of $25.8B and became the leader in the medical device industry

- Novartis raised its sales by 16% and acquired Alcon (ophthalmic business), Genoptix (oncology business) and 85% stake in Zhejiang Tianyuan (vaccine business)

- Bayer recorded a revenue of $49B, pharmaceutical business posted an encouraging performance in emerging market. Bayer's sales of general medicine increased by 1.2%

2012

- Johnson and Johnson delivered solid results in 2012 with profitable growth with their top and newly products and generated the revenue of $67.2B. J&J acquired Synthes to boost its orthopedics and neurology business

- In 2012, Novartis faced a dipped sale of 3% forced by -0economics side effects, increased price pressure and patent expiration. Novartis generic division Sandoz faced and production downtown lead to a decline in of 4%. Sandoz acquired Fougera Pharmaceuticals to become a leader in generic dermatology

- Pfizer reported a weak performance, the drug maker lost the exclusivity for several top products, including Lipitor

- Gilead acquired Pharmasset to strengthen its infectious disease portfolio

2013

- Johnson and Johnson delivered an outstanding performance with a collective revenue of $71B, their pharmaceutical segment rose to a phenomenal level of 10.9% with a primary contribution from Remicade & Simponi. Its Medical device & Diagnostic segment achieved 6.1% operational growth

- Novartis reported a significant progress with all divisions contributing a strong performance with a group's net sales of $57.9B. Their multiple sclerosis drug Gilenya saw sales rise of 62%, Afinitor's sales raised to 66% and Galvus generated the revenue of $1.2B

- Abbott Laboratories spun-off its branded pharmaceutical business into Abbvie

- Amgen acquired Onyx Pharmaceuticals to boost its portfolio of Immuno-Oncology

2014

- Johnson and Johnson attained a strong growth in 2014 with momentum in their pharmaceutical business and strong sales of their new core products contributing $32.2B. Johnson's continued its market leadership in medical devices & diagnostics expecting 30+ new filings of devices in H2'16. Johnson's acquired Covagen, Alios BioPharma and ORSL brand from Jagdale Industries

- Novartis acquired CoStim Pharmaceuticals, WaveTec Vision Systems and divested its 22% stake in Idenix to Merck

- Bayer acquired Dihon Pharmaceutical including, Biagro and Granar and consumer business of Merck

- Roche acquired InterMune to expand its portfolio for pulmonary and fibrotic diseases

- Actavis acquired Forest Laboratories for $28B to create a specialty pharmaceutical with more than 35 products including five blockbuster drugs

2015

- Johnson and Johnson's revenue declined by 5.7% compared to 2014 with the expiration of the patent of its core drugs and its Hepatitis C products, Olysio/Sovriad & Incivo has a negative impact of 2.7% due to the introduction of competitive products

- Pfizer steadied its performance in 2015, their revenue decreased by 2% but reflected an operational increase of 6%, the impact of foreign currency and higher restructuring charges and rise in competition for BeneFIX, ReFacto, Xyntha and Enbrel. Pfizer acquired Hospira, a leading provider of injectable drugs

- In 2015, Novartis revenue dipped by 5%, its growth products accounted for 34% of the net sales, revenue from the current products reduced to 34% and sales in the emerging market is 7% low compared to 2014. Novartis acquired Admune Therapeutics, acquired GSK's oncology products and divested its vaccine business to GSK

- Bayer reported steady growth in revenue of 12.1% compared to 2015. The consumer health business growth was 6.1% with an impact of integration of the business acquired from Merck

- AbbVie acquired Pharmacyclics in the second quarter to enhance their leadership in hematological Oncology

2016

- Johnson and Johnson showed a stable growth in 2016, with the revenue of $71.9B, their lead drug Remicade generated sales of 9.7% of the total revenue, experienced significant challenges due to whose patents set to expire in 2018

- Pfizer reported a significant progress in 2016 with the approval of five products and gained a revenue of $52.8B. Its top 10 products achieved the revenue of more than $1B each. Pfizer completed the acquisition of Medivation for $14B to strengthen its leadership in Oncology

- Novartis continued to strengthen its business even after several issues including loss of US patent for its core drug product, Gleevec. Its growth products increased the sales by 20%, its generic division, Sandoz contributed $10.1B in group's revenue and $5.8B was Alcon's net sales

- Shire merged with Baxalta to create a global company with a market leader in the rare disease portfolio

- Teva acquired Generic business of Actavis generics for $39B

2017

- Johnson and Johnson experienced a rapid growth of $76B, their lead drug Remicade accounted for approximately 8.3% of the company's revenue. In 2017, sales growth had positive impact due to acquisitions and divestitures by 3.6%.

- Pfizer stood at a stable revenue position with an approximately $3.2B negative revenue impact due to loss of exclusivity. In February, Pfizer divested its Infusion Systems net assets to ICU Medical

- Novartis recorded a constant revenue, in its pharmaceutical division and eye care division. Sandoz division's revenue declined due to price competition

- In October 2017, Gilead Science acquired Kite Pharma to strengthen its leadership in Cell Therapy

2018

- Johnson and Johnson achieved operational sales growth of 6.3% and generated a revenue of $81.6B, its pharmaceutical sales increased by 12.4%, medical device sales by 1.5% and the consumer division achieved 1.8% as compared to 2018

- Novartis recorded the sales of $52B, Sandoz division contributed 19% of the group's total net sale. Novartis intended to separate its eye care division, Alcon into an independent company which is expected to be completed in 2019. Novartis also acquired Endocyte, Tear Film Innovations and AveXis

- Pfizer divested its 36.5% stake in GSK Consumer Healthcare to GSK. Pfizer generated a revenue of $53.6B with a 2% increase as compared to 2017 with the impact of income from continuing operations

- Sanofi acquired Bioverativ to expand its rare disease pipeline and Ablynx, a Nanobodies drug discovery company

Source: Company Annual Reports/10Ks/Company press release

Tags

This content piece was prepared by our former Senior Editor. She had expertise in life science research and was an avid reader. For any query reach out to us at connect@pharmashots.com