Know Your Investor: BVF Partners L.P. (September’24 Edition)

Shots:

- An equity hedge fund manager company, BVF Partners invests in small cap and early-stage biotechnology companies

- In 2023, BVF participated in five investment rounds and added 20 companies to its portfolio

- For a curated report on a specific investor or venture capital, reach out to us at connect@pharmashots.com

Established in 1993 in San Francisco, California, BVF Partners is an equity hedge fund manager and a venture capital firm that primarily invests in biotechnology companies. With a specialization in providing early-stage finance contributions for the advancements in the biotech industry, BVF emphasizes long-term investments by concentrating its efforts on the small-cap segment of the biotechnology sector.

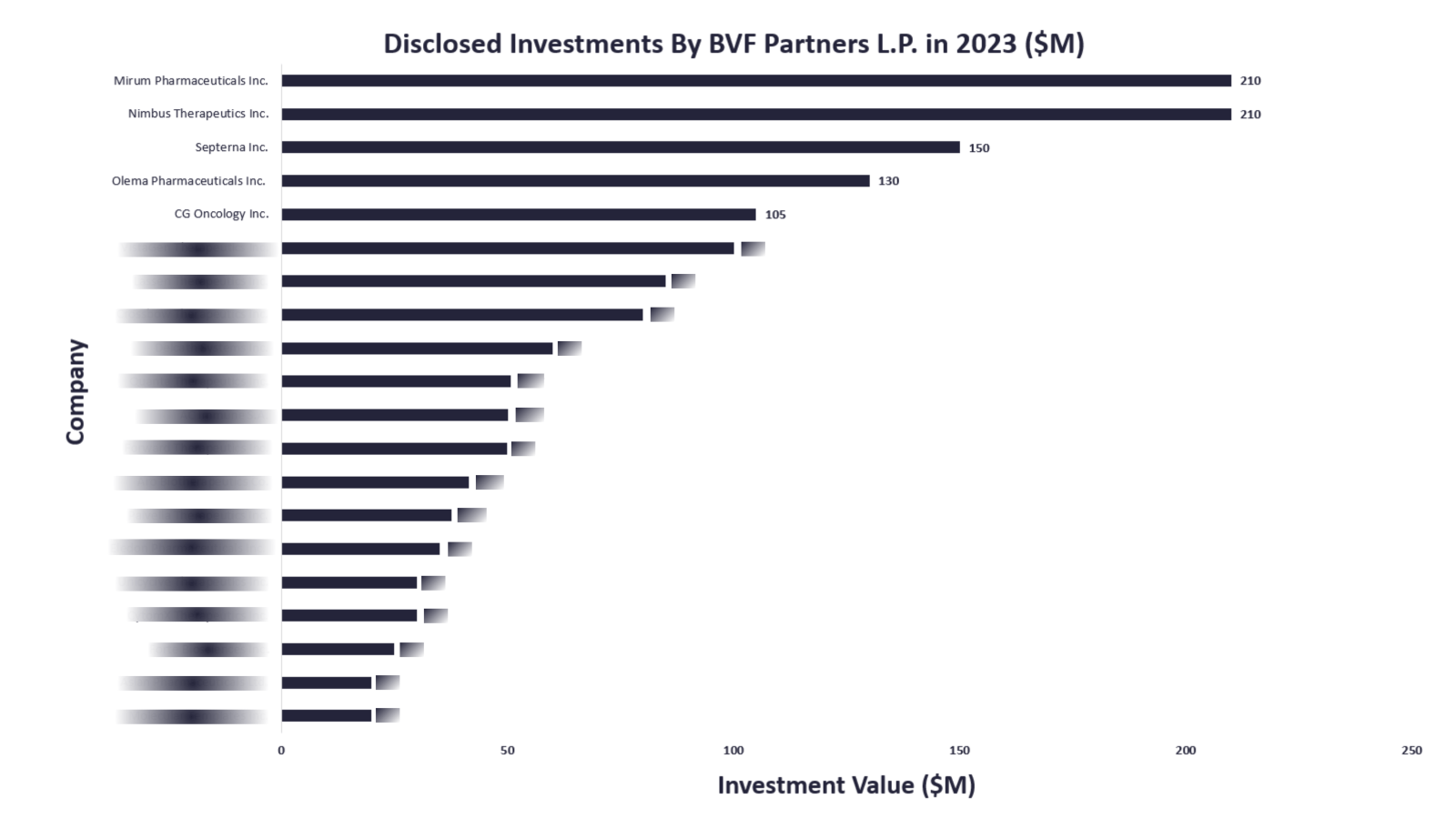

In 2023, BVF Partners invested through PIPE, Series A, B, D, and F series, followed by one private investment and added Mirum Pharmaceuticals, Forward Therapeutics, Septerna, CG Oncology (formerly Cold Genesys), and VistaGen Therapeutics in its portfolio. In 2023, Mirum Pharmaceuticals received the highest funding worth $210M through PIPE funding.

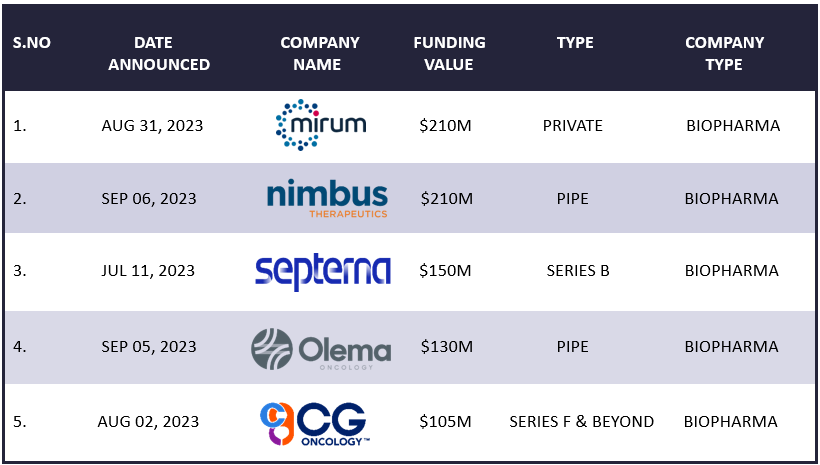

In 2023, BVF Partners invested in 20 companies dedicated to biopharma and devices. Among the 20 investments, 19 were in biopharma companies. BVF invests in companies focusing on oncology, autoimmune, dermatology, endocrine/metabolic, hepatic, inflammatory, neurology, ophthalmology, and renal. The company also invests in technologies leveraging antibodies, gene therapy, immunotherapy, protein, small molecules, and formulation - topical/other. Around 55% of BVF Partners' total investments in 2023 were made through PIPE, and 15% through Series B. BVF Partners' top three investments are:

- PIPE funding worth $210M to Mirum Pharmaceuticals

- Private funding worth $210M to Nimbus Therapeutics

- Series B funding worth $150M to Septerna

In 2023, BVF Partners made:

- 4 investments worth $147.7M in Q1

- 3 investments worth $115.7M in Q2

- 8 investments worth $930M in Q3

- 5 investments worth $326.6M in Q4

The following table represents the top 5 out of the 20 investments made by BVF Partners

Note: (For a complete report, reach out to us at connect@pharmashots.com with the subject line "BVF Partners" or for early access to complete data for future reports and analysis register here: https://forms.office.com/r/VwFu6aUm80)

Related Post: Know Your Investor: Arch Venture Partners (August’24 Edition)

Tags

An avid reader and a dedicated learner, Prince works as a Content Writer at PharmaShots. Prince possesses an exceptional quality of breaking down the barriers of words by simplifying the terms in digestible chunks to make content readable and comprehensible. Prince likes to read books and loves to spend his free time learning and upskilling himself.