Top 20 Companies Spending on R&D in 2022

Shots:

- R&D (Research and Development) in the biopharma industry lays the foundation stone of innovative drugs. A robust R&D bolstered with new-age technological advances assures long-term sustainability in the future market

- With a global expenditure of $238B in 2022, the figures are anticipated to reach $285B by 2028. In 2022, AbbVie ranked the top among the companies spending on R&D with a total R&D expense of $55B followed by Roche and Johnson & Johnson with $15.20B and $14.60B respectively

- PharmaShots presents a succinct report on the Top 20 Companies Spending on R&D in 2022

20. Abbott

R&D Expenditure: $2.88B

Market Cap: $180.25B

Founded Year: 1888

Total Employees: ~115,000

Headquarters: Illinois, United States

Stock Exchange: NYSE

- Abbott Laboratories discovers and develops a wide range of therapeutic products under its broad portfolio. Diagnostics, Medical Devices, Nutritional, and Branded Generic Medicines are the business segments the company operates under

- In 2022, Abbott increased its R&D investment, which led to an increase in the company’s spending on various projects to advance products in development. Abbott builds country-specific portfolios containing quality medicines to meet patients’ needs

- Additionally, Abbott looks forward to expanding its existing brands into new markets, implementing product enhancements that provide value to patients, and acquiring strategic products and technology through licensing activities. The company is actively working on the further development of its products, including Creon, Duphaston, Femoston, and Influvac

19. Moderna

R&D Expenditure: $3.29B

Market Cap: $42.28B

Founded Year: 2010

Total Employees: ~2,700

Headquarters: Massachusetts, United States

Stock Exchange: NASDAQ

- Moderna is an American multinational healthcare company that develops products by leveraging the therapeutic properties of mRNA. The company’s mRNA platform is a coalesce of mRNA, delivery, and the manufacturing process. Components are integrated with different versions of mRNA to form a therapeutic entity

- In 2022, Abbott allocated funds to develop its platform, discover development candidates, clinical development of its programs, develop or manufacture technology and infrastructure, and digital infrastructure costs related to the company’s drug discovery and clinical trials

- Currently, Moderna runs 48 development programs across 45 development candidates, out of which 38 programs are under clinical evaluation

18. Novo Nordisk

R&D Expenditure: $3.46B

Market Cap: $318.27B

Founded Year: 1923

Total Employees: ~55,180

Headquarters: Bagsvaerd, Denmark

Stock Exchange: N/A

- Novo Nordisk is a multinational healthcare company that discovers and develops innovative biological medicines. The company primarily focuses on Obesity, Rare Diseases, Chronic Diseases, Cardiovascular Diseases, Non-alcoholic Steatohepatitis, Chronic Kidney Diseases, and Alzheimer’s Diseases

- Novo Nordisk’s 2022 R&D expenditure rose by 35% led by an increased late-stage clinical trial activity in 2022. The increase in 2022 R&D expenditure was attributed to the increased activities within other serious chronic diseases and GLP-1 along with increased operating costs and amortization related to Dicerna Pharmaceuticals, acquired by Novo Nordisk in Q4’21

- Under its development pipeline, the company focuses on developing therapy options for Diabetes Care, Obesity Care, Rare Diseases, and other Serious Chronic Diseases

17. Regeneron

R&D Expenditure: $3.59B

Market Cap: $91.66B

Founded Year: 1988

Total Employees: ~11,850

Headquarters: New York, United States

Stock Exchange: NASDAQ

- Regeneron is developing, manufacturing, and commercializing therapeutic entities to treat serious diseases. Eye diseases, allergic and inflammatory diseases, cancer, cardiovascular and metabolic diseases, pain, hematologic conditions, infectious diseases, and rare diseases are its key therapy areas

- As compared to 2021, Regeneron’s 2022 R&D expense increased partially due to the impact of the amendments to the company’s collaboration agreement with Sanofi. The R&D expenses also included stock-based compensation expenses of $406.8M, which was $316.6M in 2021

- Under Ophthalmology, the company is currently developing Eylea and Aflibercept, Dupixent, and Kevzara among others under Immunology & Inflammation, and Libtayo, Fianlimab, Vidutolimod, and Ubamatamab under Solid Organ Oncology

16. Takeda

R&D Expenditure: $4.29B

Market Cap: $47.84B

Founded Year: 1781

Total Employees: ~50,000

Headquarters: Tokyo, Japan

Stock Exchange: TYO

- Driven by the idea of developing, manufacturing, and commercializing therapeutic products for patients globally, Takeda is a renowned name in the biopharma industry. The company focuses on therapeutic entities targeting Oncology, Metabolic Disorders, Gastroenterology, Neurology, and Immunology. The company has built a deep and highly innovative pipeline through its R&D transformation with around 40 new molecule entities in the clinical stage

- In 2022, Takeda’s R&D expense increased by 20.4% as compared to 2021. The increase in R&D expenses was mainly attributed to the depreciation of the Japanese Yen

- Innovative Biopharma, Plasma-Derived Therapies (PDT), and Vaccines are the three areas upon which the company focuses its R&D efforts. Currently, Takeda’s development pipeline contains around 40 new molecular entities

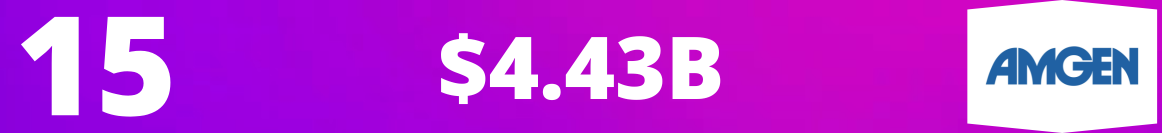

15. Amgen

R&D Expenditure: $4.43B

Market Cap: $139.45B

Founded Year: 1980

Total Employees: ~25,200

Headquarters: California, United States

Stock Exchange: NASDAQ

- A multinational biotech company, Amgen discovers, develops, manufactures, and commercializes innovative therapeutic entities to treat severe illnesses and diseases with limited treatment options. Enbrel, Prolia, Otezla, and Xgeva are some of the key products developed by the company

- In 2022, the net R&D expense of Amgen decreased by 7.98% mainly due to a comparatively higher business development activity in 2021 which included lower marketed product support, higher later-stage clinical program support, and higher research and early pipeline spending

- Furthermore, the company continued to advance its pipeline in 2022 by initiating a P-III clinical trial for various programs including Lumakras/Lumykras for the treatment of advanced colorectal cancer, olpasiran for cardiovascular disease, and rocatinlimab for the treatment of atopic dermatitis

14. Gilead

R&D Expenditure: $4.97B

Market Cap: $94.62B

Founded Year: 1987

Total Employees: ~17,000

Headquarters: California, United States

Stock Exchange: NASDAQ

- Gilead Sciences is a biopharma company that discovers and develops innovative medicines to prevent and treat life-threatening diseases. The company focuses on therapy areas of HIV, COVID-19, Viral Hepatitis, and Oncology. Its HIV segment is the highest contributor to the company’s net revenue through the sales of Biktarvy, Genvoya, and Descovy, among others

- In 2022, the company’s R&D expense increased by 7.55% vs 2021 primarily due to a higher clinical development spent by the company related to Trodelvy and the Arcus Bioscience collaboration along with inflationary increases

- Currently, Gilead has filed various products for regulation, including Bulevirtide and Sacituzumab govitecan-hziy among others. Various products are under evaluation including Lenacapavir and Axicabtagene ciloleucel among others in P-III clinical trials and Brexucabtagene autoleucel in P-II clinical trials

13. Boehringer Ingelheim

R&D Expenditure: $5.41B

Market Cap: N/A

Founded Year: 1885

Total Employees: ~53,150

Headquarters: Ingelheim, Germany

Stock Exchange: N/A

- Boehringer Ingelheim discovers and develops therapeutic entities for the betterment of both human and animal health. Human Pharma, Animal Health, and Biopharmaceutical Contract Manufacturing are the three divisions under which the company functions

- The highest amount contributed to the company’s total revenue comes from the sales of its product under Human Pharma. Boehringer’s 2022 R&D expense increased by 22.29% as compared to 2021. The company invested a total of $5.3B in the R&D of new medicines in 2022, out of which a total of $4.9B was invested in the Human Pharma segment

- Boehringer continues its clinical development of therapeutic entities for Cardiometabolic Diseases, Oncology, Respiratory Diseases, Immunology, Central Nervous System Diseases, and Retinal Diseases

12. AbbVie

R&D Expenditure: $6.51B

Market Cap: $265.04B

Founded Year: 2013

Total Employees: ~50,000

Headquarters: Illinois, United States

Stock Exchange: NYSE

- A multinational biopharma company, AbbVie discovers and delivers innovative medicines and solutions that address health issues across various therapeutic areas. The company develops products under its segments, including Immunology, Hematology, Oncology, Aesthetics, Neuroscience, and Eye Care. In 2022, the R&D expenses of AbbVie decreased as compared to 2021

- The recession in R&D expenditure was attributed to the impact of the increased scale of the combined company and synergies realized, the purchase of priority review vouchers from third parties in the prior year along with lower integration costs concerning the acquisition of Allergan

- Currently, the company has various products under clinical development, including therapy options for the treatment of complex life-threatening diseases. AbbVie’s development pipeline includes over 80 products that are being developed individually or under collaboration or license agreement

11. GSK

R&D Expenditure: $6.65B

Market Cap: $70.75B

Founded Year: 2000

Total Employees: ~69,400

Headquarters: London, United Kingdom

Stock Exchange: LON

- GSK is a British multinational healthcare company that discovers and develops therapeutic products. Infectious Diseases, HIV, Immunology, Respiratory, and Oncology are the key therapy areas for which the company develops its products. GSK functions under its business segments in General Medicines, Specialty Medicines, and Vaccines

- In 2022, the company’s R&D expenditure increased by 9% at AER and 4% at CER vs 2021. GSK strengthened its pipeline and platform capabilities through strategic business development

- The company currently has 22 vaccines and 47 medicines under development. Bexsero, Xevudy, Blenrep, Jemperli, and Zejula are some of the products that the company looks forward to evaluating under the P-III clinical trial or are in the registrational phase

10. Bayer

R&D Expenditure: $7.05B

Market Cap: $53.94B

Founded Year: 1863

Total Employees: ~101,370

Headquarters: Leverkusen, Germany

Stock Exchange: ETR

- Bayer is a multinational healthcare company that develops and commercializes a wide range of therapeutic entities. Life Sciences, Healthcare, and Agriculture are three business segments under which the company operates. Bayer primarily focuses on developing therapeutic options for Oncology, Cardiovascular, and kidney diseases

- Bayer’s 2022 R&D expenditure rose by 21.43% as compared to 2021. In 2022, the company’s pharmaceutical division paved the way for a transformed R&D process

- Bayer developed precision therapeutics to address the unmet needs for severe cancer and immune disorders by leveraging novel technologies. In 2022, the company opened a new Bayer Research & Innovation Center (BRIC) in Boston-Cambridge, Massachusetts, United States as a research center for molecular precision oncology

9. Eli Lilly

R&D Expenditure: $7.19B

Market Cap: $522.16B

Founded Year: 1876

Total Employees: ~21,000

Headquarters: Indianapolis, United States

Stock Exchange: NYSE

- An American multinational pharma company, Eli Lilly discovers, develops, manufactures, and markets products for the wellness of patients. The target therapy areas are Diabetes, Oncology, Immunology, and Neuroscience

- In 2022, the company’s R&D expense increased by 3.75% as compared to 2021. The increase in the R&D expense was primarily led by higher development expenses for late-stage assets, partially offset by lower development expenses for COVID-19 antibodies and the favorable impact of foreign exchange rates

- The company is currently evaluating Basal Insulin-Fc for the treatment of Type 1 and 2 diabetes in a P-III clinical trial, ANGPTL3 siRNA, LP(a) Inhibitor, and LP(a) siRNA for the treatment of cardiovascular disease in a P-III clinical trial among others

8. Sanofi

R&D Expenditure: $7.19B

Market Cap: $227.89B

Founded Year: 2004

Total Employees: ~91,573,440

Headquarters: Paris, France

Stock Exchange: NASDAQ

- A multinational pharma and healthcare company, Sanofi, dedicatedly develops, manufactures, and markets pharmacological products. The company focuses on Oncology, Cardiovascular, Neurology, Immunology, and Inflammation. Sanofi functions under its business segments Pharmaceuticals, Vaccines, and Consumer Health

- The company’s 2022 R&D expense increased by 17.81% as compared to 2021. Out of the total R&D expenses, $5.44B was invested in the company’s pharmaceutical segment, $200.69M in the Consumer Healthcare segment, $1.00B in the Vaccines segment, and $553.79M was invested in other segments

- The increase in the company’s R&D expenses was attributed to the additional investments in Immunology and the mRNA vaccines platform. Moreover, the investment in the company’s preclinical research and clinical development was also increased

7. BMS (Bristol Myers Squibb)

R&D Expenditure: $9.50B

Market Cap: $129.34B

Founded Year: 1887

Total Employees: ~34,300

Headquarters: New York, United States

Stock Exchange: NYSE

- Indulged in the discovery, development, and commercialization of a wide range of products, Bristol-Myers Squibb (BMS) works with the mission to deliver innovative medicines for patients with serious diseases. The company focuses on therapy areas of Oncology, Hematology, Immunology, Cardiovascular Diseases, and Fibrosis

- In 2022, the company’s R&D expenses declined by 6.73% as compared to 2021. The company’s 2022 expenses decreased due to lower IPRD impairment charges and were partially offset by the cash settlement of Turning Point’s unvested stock awards in 2022

- The company is currently developing various products under its development pipeline, including Abecma, Reblozyl, Opdivo, Opdualag, Sotyktu, and Camzyos among others

6. AstraZeneca

R&D Expenditure: $9.76B

Market Cap: $267.05B

Founded Year: 1923

Total Employees: ~83,500

Headquarters: Cambridge, United Kingdom

Stock Exchange: LON

- AstraZeneca is a multinational healthcare company propelled by the idea of discovering, developing, and commercializing therapeutic entities. The company focuses on key therapy areas, including Oncology, Cardiology, Gastrointestinal Infections, and Inflammation

- In 2022, AstraZeneca’s total R&D expense increased by 2.76% as compared to 2021. The investment increased in 2022 to support the company’s late-stage assets across oncology and biopharmaceuticals. Additionally, discovery investments were increased to take advantage of the new-age technologies, including cell therapy for which the company acquired Neogene

- AstraZeneca spent $2,051M of its R&D expense to acquire the rights for several products and $111M on the implementation of its R&D restructuring strategy. Currently, the company has around 179 projects under its development pipeline, out of which 155 are under clinical development

5. Novartis

R&D Expenditure: $9.99B

Market Cap: $236.32B

Founded Year: 1996

Total Employees: ~102,000

Headquarters: Basel, Switzerland

Stock Exchange: SWX

- Novartis is a multinational global healthcare company that discovers, develops, and delivers therapeutic entities to fulfill unmet healthcare needs. The therapy areas for which the company mainly develops its products are Oncology, Hepatology, Immunology, Dermatology, Musculoskeletal Diseases, Neurosciences, and Ophthalmology. The company works under its operating division, namely Innovative Medicines and Sandoz

- In 2022, Novartis spent 6.14% more on its Innovative Medicine Division research and development expenses as compared to 2021. The increase in the R&D expense was attributed to the higher impairment charges and higher investment made in development to support the recently acquired assets

- The company is currently developing AVXS-101, Beovu, CFZ533, Coartem, and Cosentyx among others under its development pipeline

4. Pfizer

R&D Expenditure: $11.42B

Market Cap: $208.96B

Founded Year: 1849

Total Employees: ~83,000

Headquarters: New York, United States

Stock Exchange: NYSE

- A research-based, global healthcare company, Pfizer holds a significant spot amongst biopharma companies. The company focuses on discovering, developing, manufacturing, and marketing products in various therapeutic areas including, Oncology, Immunology, Cardiology, Endocrinology, and Neurology. Pfizer functions under its business segments including Primary Care, Specialty Care, and Oncology

- In 2022, the company’s R&D expense increased by 10.31% as compared to 2021. The increase in the R&D expense was led primarily by an unfavorable impact of $4.0B due to the increased sales of Comirnaty that included a charge for the 50% gross profit split with BioNTech and application royalty expenses. The expenses also increased due to inventory write-offs and other charges related to Paxlovid and Comirnaty

- On the other hand, the increase in R&D expenses was also partially offset by a $3.3B favorable impact of foreign exchange and hedging activity

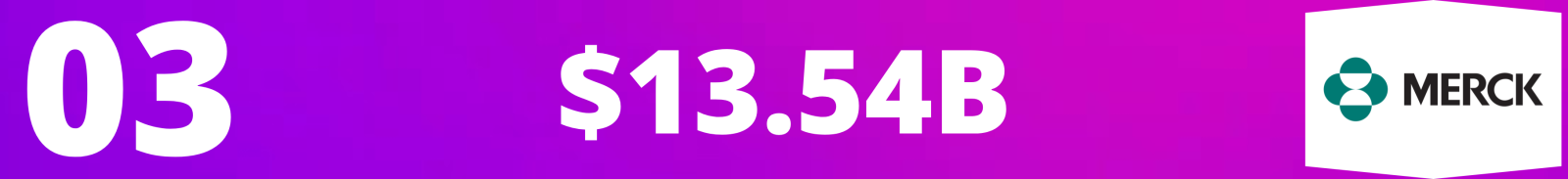

3. Merck

R&D Expenditure: $13.54B

Market Cap: $278.21B

Founded Year: 1891

Total Employees: ~69,000

Headquarters: New Jersey, United States

Stock Exchange: NYSE

- Merck & Co. is a biopharma company involved in the discovery, development, and commercialization of therapeutic entities for the treatment of various therapy areas. The company divides its business into two segments, including Pharmaceutical and Animal Health

- In 2022, the company’s R&D expenses increased by 11% as compared to 2021. The rise in Merck’s R&D expenses was primarily due to higher intangible asset impairment charges, higher charges for upfront and option payments related to collaborations and licensing arrangements, and higher compensation. Currently, the company has several products under regulatory review in the US and internationally

- Merck’s clinical pipeline contains therapeutic entities for the treatment of multiple therapy areas including Cancer, Cardiovascular Diseases, Metabolic Diseases, Infectious Diseases, Neurosciences, Respiratory Diseases, and Vaccines

2. Johnson & Johnson

R&D Expenditure: $14.60B

Market Cap: $434.94B

Founded Year: 1886

Total Employees: ~152,700

Headquarters: New Jersey, United States

Stock Exchange: NYSE

- Delving into the business of developing healthcare products, Johnson & Johnson is a renowned name in the pharma industry. The company focuses on developing key therapeutic entities under therapy areas, including Oncology, Cardiovascular Diseases, Immunology, and Endocrinology. Johnson & Johnson divides its business into Pharmaceutical, Medical Device, and Consumer Health divisions

- Stelara, Darzalex, Trevicta, and Imbruvica are among the key players contributing to the company’s net revenue

- In 2022, the company’s R&D expenses decreased by 0.75% as compared to 2021. The decrease in the R&D expense was attributed to the lower milestone payments generated in the company’s pharmaceutical business

1. Roche

R&D Expenditure: $15.20B

Market Cap: $238.07B

Founded Year: 1896

Total Employees: ~1,03,600

Headquarters: Basel, Switzerland

Stock Exchange: SWX

- Roche is a multi-disciplinary biopharma company that develops Pharmaceutical and Diagnostic Products. The company focuses on Oncology, Immunology, Ophthalmology, Cardiovascular, and Respiratory

- In 2022, the company’s R&D expenditure increased by 1.20% as compared to 2021. The rise in the company’s research and development expenses was mainly attributed to the enhanced focus on the cancer immunotherapy portfolio. Roche also increased its research investments in Neuroscience and Ophthalmology

- In 2022, Roche increased its investments in Spark Therapeutics to support investigational programs such as hemophilia A and B and studies related to Pompe disease. The company also had continued investments in research and development activities in China. Roche’s pipeline currently includes 87 new molecular entities covering a broad range of diseases and innovative technologies

Sources:

- Annual reports

- SEC Filings

- Press releases

- Company websites

Market Cap Source: Google Finance (22nd Aug 2023)

Currency Conversion: X-Rates (22nd Aug 2023)

Note:

- All market caps were reported on 22nd Aug 2023

Related Posts: Top 20 Vaccines Based on 2022 Total Revenue

Tags

Shivani was a content writer at PharmaShots. She has a keen interest in recent innovations in the life sciences industry. She was covering news related to Product approvals, clinical trial results, and updates. We can be contacted at connect@pharmashots.com.