Know Your Investor: Orbimed (February’ 25 Edition)

Shots:

- The February edition highlights OrbiMed Advisors, a New York-based investment firm specializing in public and private investments within the healthcare and biotech sectors

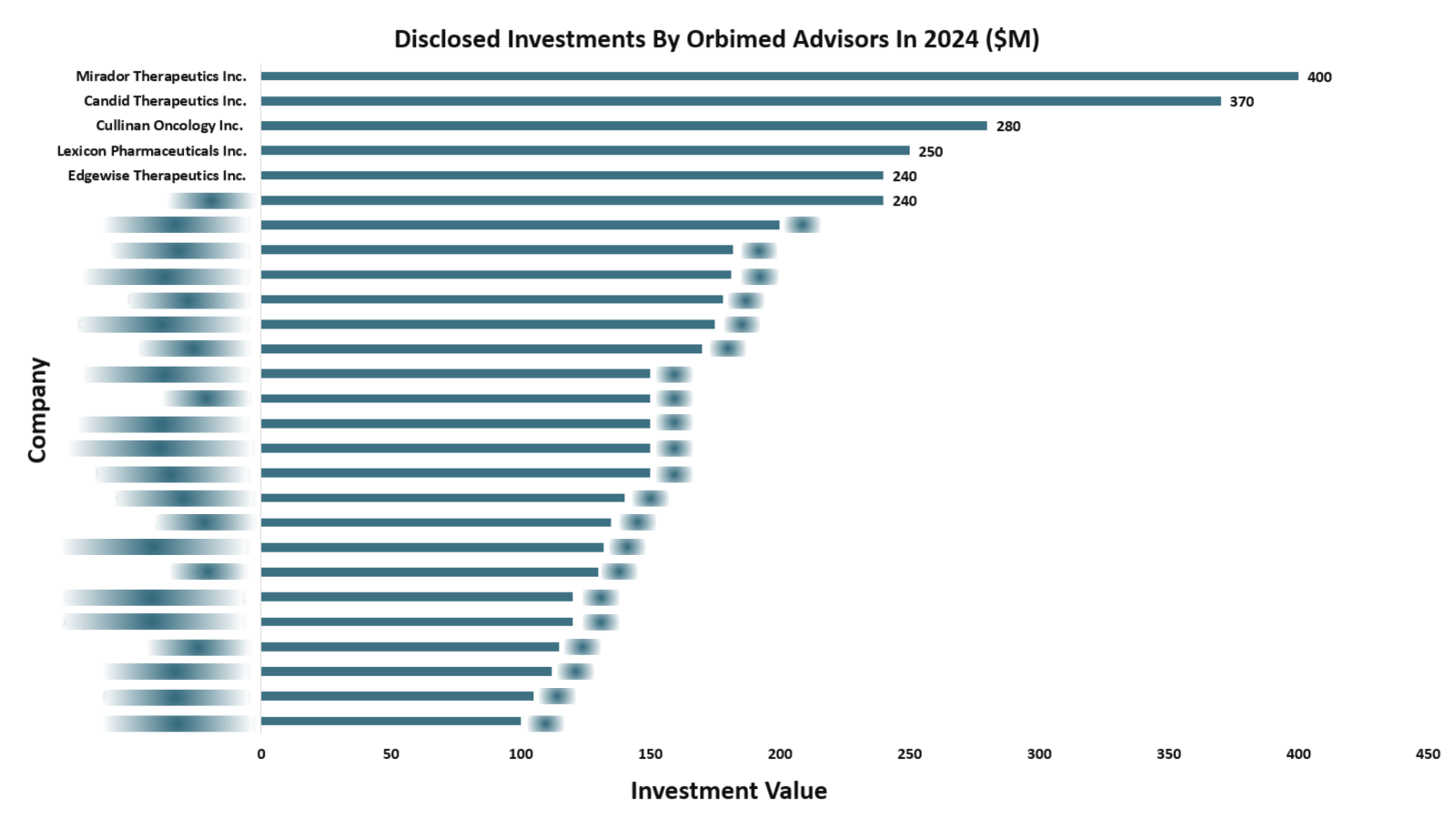

- In 2024, OrbiMed expanded its portfolio by adding 49 companies, investing approximately $6.08B across five funding rounds, including private and debt financing

- For the complete report, contact us at connect@pharmashots.com

Founded in 1989, OrbiMed Advisors is a global healthcare investment firm led by 21 partners. The firm finances a broad range of companies, from early-stage startups to large multinationals, across private equity, public equity, royalty, and credit funds. Headquartered in New York City, OrbiMed has a global presence with offices in London, San Francisco, Shanghai, Hong Kong, Mumbai, and Herzliya.

Founded in 1989, OrbiMed Advisors is a global healthcare investment firm led by 21 partners. The firm finances a broad range of companies, from early-stage startups to large multinationals, across private equity, public equity, royalty, and credit funds. Headquartered in New York City, OrbiMed has a global presence with offices in London, San Francisco, Shanghai, Hong Kong, Mumbai, and Herzliya.

OrbiMed primarily targets the biotechnology and healthcare sectors, investing in companies with the potential to innovate from the ground up. Its extensive portfolio includes over 195 companies, featuring notable names such as AbCellera, Acelyrin, Actus Medical, and Adaptive Biotechnologies.

In 2024, OrbiMed participated in five funding rounds, including PIPE and Series A-D, along with three private equity and one debt financing round. This led to the addition of several companies, including Candid Therapeutics, Belenos Biosciences, Avenzo Therapeutics, and Enyo Pharma, to its growing portfolio. The largest investment of the year went to Mirador Therapeutics, which secured $400M in a Series A funding round.

In 2024, OrbiMed participated in five funding rounds, including PIPE and Series A-D, along with three private equity and one debt financing round. This led to the addition of several companies, including Candid Therapeutics, Belenos Biosciences, Avenzo Therapeutics, and Enyo Pharma, to its growing portfolio. The largest investment of the year went to Mirador Therapeutics, which secured $400M in a Series A funding round.

OrbiMed strategically invests in biopharmaceutical companies at the discovery and development stages, MedTech and medical device firms, as well as healthcare IT and service providers. The firm’s therapeutic focus spans across Autoimmune, Oncology, Cardiovascular diseases, Dermatology, Endocrine/Metabolic disorders, Gastrointestinal diseases, Hematology, Hepatology, Infectious diseases, Inflammation, Musculoskeletal disorders, Neurology, Pulmonary diseases. In terms of technological focus, OrbiMed prioritizes investments in antibodies, biologics, RNA-based therapies, and vaccines.

OrbiMed strategically invests in biopharmaceutical companies at the discovery and development stages, MedTech and medical device firms, as well as healthcare IT and service providers. The firm’s therapeutic focus spans across Autoimmune, Oncology, Cardiovascular diseases, Dermatology, Endocrine/Metabolic disorders, Gastrointestinal diseases, Hematology, Hepatology, Infectious diseases, Inflammation, Musculoskeletal disorders, Neurology, Pulmonary diseases. In terms of technological focus, OrbiMed prioritizes investments in antibodies, biologics, RNA-based therapies, and vaccines.

In 2024:

-

Invested in 49 companies

-

40.8% of investments were through PIPE

-

32.6% were through Series A and Series B

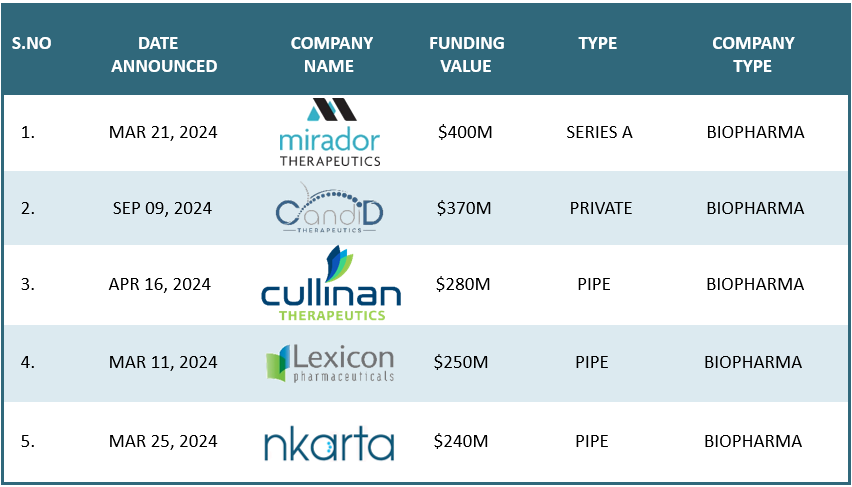

Key Investments in 2024:

-

$400M Series A funding to Mirador Therapeutics

-

$370M Private funding to Candid Therapeutics

-

$280M PIPE funding to Cullinan Oncology

Quarterly Investments in 2024:

-

Q1: 17 investments worth $2.67B

-

Q2: 7 investments worth $0.87B

-

Q3: 10 investments worth $1.05B

-

Q4: 15 investments worth $1.48B

The table below depicts the top 5 out of the 49 investments made by Orbimed Advisors:

Note: (For the complete report, reach out to us at connect@pharmashots.com with the subject line "Orbimed" or for early access to complete data for future reports and analysis register here: https://forms.office.com/r/VwFu6aUm80)

Related Post: Know Your Investor (April Edition): OrbiMed Advisors

Tags

An avid reader and a dedicated learner, Prince works as a Content Writer at PharmaShots. Prince possesses an exceptional quality of breaking down the barriers of words by simplifying the terms in digestible chunks to make content readable and comprehensible. Prince likes to read books and loves to spend his free time learning and upskilling himself.