Know Your Investor: Catalio Capital Management (November’24 Edition)

Shots:

- A New York-based venture capital fund, Catalio Capital Management invests in breakthrough MedTech and innovative healthcare companies globally

- In 2023, Catalio Capital participated in eight funding rounds and invested approximately $1.82B to add 22 companies to its portfolio

- For a curated report on a specific investor or venture capital firm, reach out to us at connect@pharmashots.com

.png)

Founded in 2020 by George Petrocheilos and R. Jacob Vogelstein, Catalio Capital Management is a venture capital firm that invests dedicatedly in innovative MedTech and healthcare companies globally. Catalio invests in all stages, from seed to crossover biomedical technology companies that create next-generation drugs, devices, diagnostics, data, tools, and healthcare services, collaborating closely with each portfolio company to foster growth from inception to exit. The company’s portfolio includes more than 80 companies, including private and public entities like Avava, ArriVent, Carbon Health, Port Therapeutics, and Atai Life Sciences.

In 2023, Catalio participated in eight funding rounds comprising PIPE (Private Investment in Public Equity), Seed, Series A, B, C, F & beyond, followed by Debt/Loan, and Series Unspecified/Private funding to add Blackrock Neurotech (formerly Blackrock Microsystems), Noetik, NextPoint Therapeutics, and others to its portfolio. In 2023, Avalyn Pharma Inc. (formerly Genoa Pharmaceuticals) received the highest funding worth $175M through Series C funding.

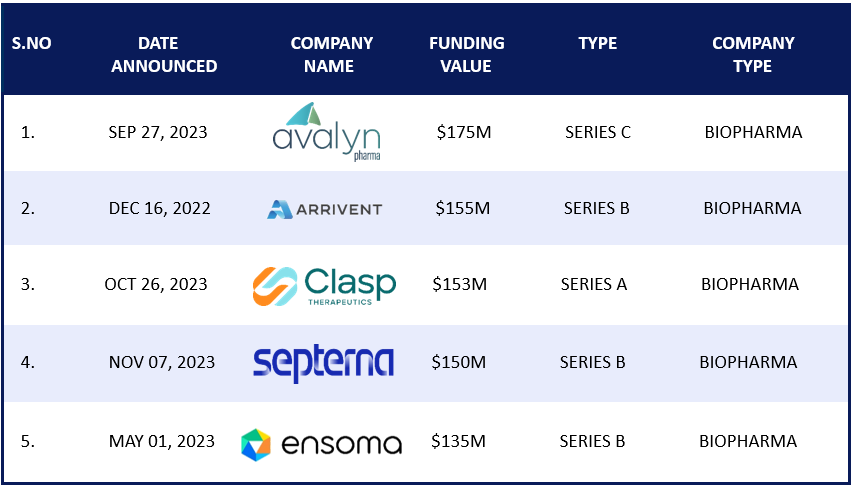

In 2023, Catalio invested in 15 companies dedicated to biopharma, followed by diagnostics, devices, Fin - VC/private equity, and manufacturing/service companies. Catalio focuses on autoimmune, cancer, endocrine/metabolic, musculoskeletal, neurology, ophthalmic, and pulmonary areas. The company makes significant investments in technologies leveraging antibodies, artificial intelligence/machine learning, general devices, gene editing/CRISPR, gene therapy, immunotherapy, radiation/radiotherapy, and small molecules. Around 31.8% of Catalio's total investments in 2023 were made through Series B and 18.1% through Series A. The company's top three investments are:

- Series C funding worth $175M to Avalyn Pharma (formerly Genoa Pharmaceuticals)

- Series B funding worth $155M to ArriVent Biopharma

- Series A funding worth $153M to ManaT Bio.

In 2023, Catalio Capital Management made:

- 7 investments worth $564.85M in Q1

- 3 investments worth $220M in Q2

- 7 investments worth $589M in Q3

- 5 investments worth $450M in Q4

.png)

The table below depicts the top 5 out of the 22 investments made by Catalio Capital Management:

Note: (For a complete report, reach out to us at connect@pharmashots.com with the subject line "Catalio Capital Management" or for early access to complete data for future reports and analysis register here: https://forms.office.com/r/VwFu6aUm80)

Related Post: Know Your Investor: Samsara Biocapital (October’24 Edition)

Tags

An avid reader and a dedicated learner, Prince works as a Content Writer at PharmaShots. Prince possesses an exceptional quality of breaking down the barriers of words by simplifying the terms in digestible chunks to make content readable and comprehensible. Prince likes to read books and loves to spend his free time learning and upskilling himself.