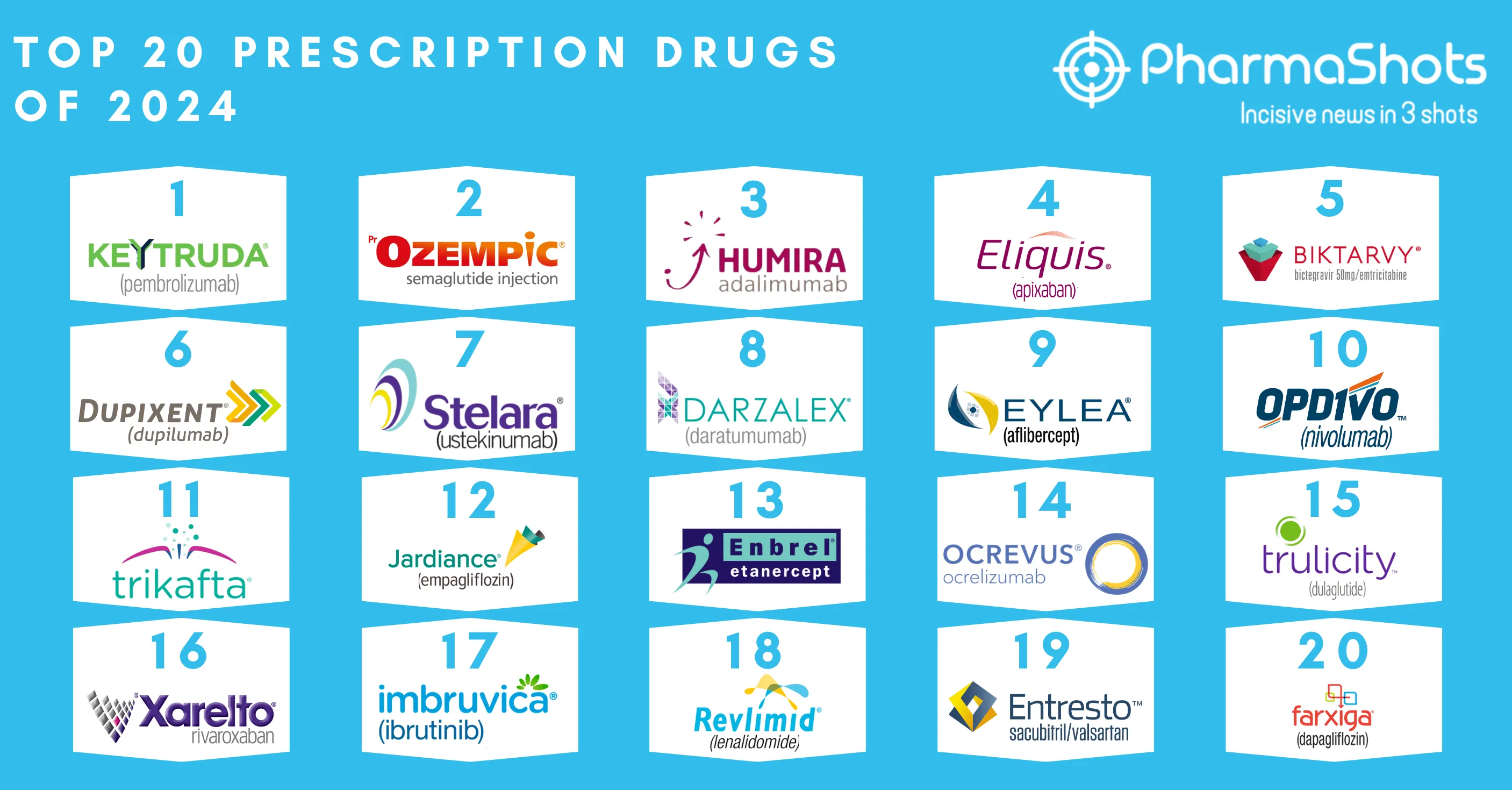

Top 20 Monoclonal Antibodies of 2024

Shots:

- Transforming care with advanced mechanisms of action, monoclonal antibody therapies hold a strong foothold in the healthcare market

- In 2021, the monoclonal antibody therapy market size was valued at $178.5B and is envisioned to reach $451.89B by 2028, displaying a CAGR of 14.1%. Keytruda with $25.01B revenue ranks first in our list followed by Humira and Dupixent with $14.4B and $11.82B respectively

- PharmaShots brings a succinct report on the Top 20 Monoclonal Antibodies based on 2023 revenue

|

Rank |

Brand Name |

Revenue (2022 $B) |

Revenue (2023 $B) |

Percent change (%) |

|

1 |

Keytruda |

20.94 |

25.01 |

19.45 |

|

2 |

Humira |

21.24 |

14.4 |

32.17 |

|

3 |

Dupixent |

8.9 |

11.82 |

32.89 |

|

4 |

Stelara |

9.72 |

10.85 |

11.67 |

|

5 |

Darzalex |

7.97 |

9.74 |

22.15 |

|

6 |

Opdivo |

8.24 |

9 |

9.21 |

|

7 |

Skyrizi |

5.16 |

7.76 |

50.3 |

|

8 |

Ocrevus |

6.52 |

7.58 |

16.15 |

|

9 |

Entyvio |

5.14 |

5.49 |

6.67 |

|

10 |

Cosentyx |

4.78 |

4.98 |

4.01 |

|

11 |

Hemlibra |

4.13 |

4.92 |

19.18 |

|

12 |

Perjeta |

4.42 |

4.47 |

1.29 |

|

13 |

Imfinzi |

2.78 |

4.23 |

52.19 |

|

14 |

Prolia |

3.62 |

4.04 |

11.57 |

|

15 |

Tremfya |

2.66 |

3.14 |

17.95 |

|

16 |

Soliris |

3.76 |

3.14 |

16.4 |

|

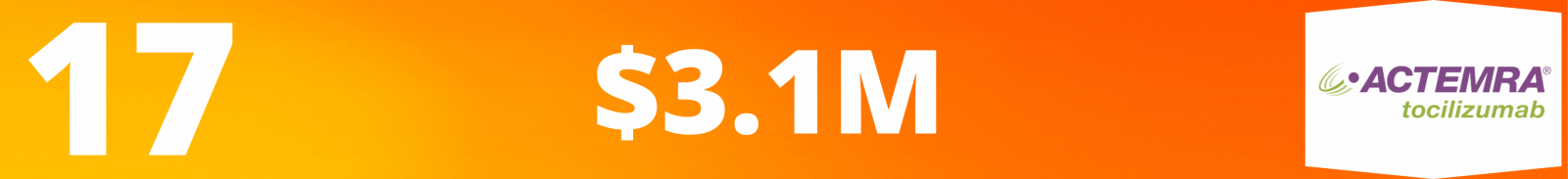

17 |

Actemra, RoActemra |

2.92 |

3.1 |

6.98 |

|

18 |

Ultomiris |

1.96 |

2.96 |

50.89 |

|

19 |

Taltz |

2.48 |

2.76 |

11.18 |

|

20 |

Xolair |

2.38 |

2.58 |

8.28 |

Note: Columns 1 and 2 represent ranks and brand names of mAb, while Columns 3, 4, and 5 showcase the total revenue of 2022, the total revenue of 2023, and the percentage change.

20. Proprietary Name: Xolair

Non-Proprietary Name: Omalizumab

Company: Roche

First Approved: US (Jun 20, 2003), EU (Oct 25, 2005)

Total Revenue: $2.58B

Indications Approved: Asthma, Chronic rhinosinusitis with nasal polyps, Chronic spontaneous urticaria

- Xolair is prescribed for Asthma, chronic rhinosinusitis with Nasal Polyps, Chronic Spontaneous Urticaria, and IgE-Mediated Food Allergy

- Xolair is a humanized IgG1 monoclonal antibody that binds to free IgE in blood and interstitial fluid and to membrane-bound IgE on B lymphocytes

- Xolair’s 2023 revenue increased by 8.28% as compared to 2022, due to higher sales worldwide. In Dec'23, the US FDA granted priority review to Xolair for children and adults with food allergies, and was approved in Feb’24

19. Proprietary Name: Taltz

Non-Proprietary Name: Ixekizumab

Company: Eli Lilly

First Approved: US (Mar 22, 2016), EU (Apr 25, 2016)

Total Revenue: $2.75B

Indications Approved: Plaque Psoriasis, Psoriatic Arthritis, Ankylosing Spondylitis, Non-Radiographic Axial Spondyloarthritis

- A humanized monoclonal antibody, Taltz is prescribed to treat Plaque Psoriasis, Psoriatic Arthritis, Ankylosing Spondylitis, Non-radiographic Axial and Spondyloarthritis

- Taltz binds to the interleukin 17A (IL-17A) cytokine and neutralizes it thus reducing inflammation

- In 2023, Taltz showed an increase of 11.18% as compared to 2022, predominantly driven by increased demand. In Oct'23, the FDA's DPV published the FAERS report of Taltz in pediatric patients less than 18 years of age

18. Proprietary Name: Ultomiris

Non-Proprietary Name: Ravulizumab

Company: AstraZeneca

First Approved: US (Dec 21, 2018), EU (Jul 02, 2019)

Total Revenue: $2.96B

Indications Approved: Paroxysmal Nocturnal Hemoglobinuria, Atypical Hemolytic Uremic Syndrome

- An IV prescription medication, Ultomiris binds and prevents the activation of complement component 5 (C5) to treat paroxysmal nocturnal hemoglobinuria and atypical hemolytic uremic syndrome

- Ultomiris is a humanized monoclonal antibody designed to attach to the C5 protein, which is part of the complement system. By attaching to the C5 protein, the Ultomiris blocks its effect and thereby reduces the destruction of red blood cells

- In 2023, Ultomiris' revenue increased by 50.89% compared to 2022, owing to high sales in the US. In May’23, Ultomiris was approved in Japan to prevent relapses in patients with neuromyelitis optica spectrum disorder

17. Proprietary Name: US (Actemra), EU (RoActemra)

Non-Proprietary Name: Tocilizumab

Company: Roche

First Approved: US (Jan 8, 2010), EU (Jan 16, 2009)

Total Revenue: $3.12B

Indications Approved: Rheumatoid Arthritis, Giant Cell Arteritis, Systemic Sclerosis-Associated Interstitial Lung Disease, Polyarticular Juvenile Idiopathic Arthritis, Systemic Juvenile Idiopathic Arthritis, Cytokine Release Syndrome, Coronavirus Disease 2019 (COVID-19)

- A humanized monoclonal antibody, Actemra is an approved interleukin-6 (IL-6) receptor inhibitor available as an IV injection. Actemra is prescribed to treat Rheumatoid Arthritis, Giant Cell Arteritis, Systemic Sclerosis-associated Interstitial Lung Disease, and Polyarticular Juvenile Idiopathic Arthritis, etc.

- In the US, it is approved by the name Actemra, while in the EU, it is marketed as RoActemra. It binds to both soluble and membrane-bound IL-6 receptors and inhibits IL-6-mediated signaling through these receptors

- Actemra’s total 2023 sales increased by 6.98% as compared to 2022, primarily driven by high sales in the US

16. Proprietary Name: Soliris

Non-Proprietary Name: Eculizumab

Company: Alexion Pharmaceuticals (AstraZeneca AB)

First Approved: US (March 16, 2007), EU (June 20, 2007)

Total Revenue: $3.14B

Indications Approved: Paroxysmal Nocturnal Hemoglobinuria (PNH), Atypical Hemolytic Uremic Syndrome (aHUS)

- Soliris is a monoclonal antibody, administered as an IV injection. It is prescribed to treat Paroxysmal Nocturnal Hemoglobinuria and Atypical Hemolytic Uremic Syndrome

- Soliris binds to the complement protein C5 with high affinity, thereby inhibiting its cleavage to C5a and C5b and preventing the generation of the terminal complement complex C5b-9

- In 2023, Soliris’ revenue showed a dip of 16.4% as compared to 2022, due to the successful conversion to Ultomiris. In Dec’23, AstraZeneca's Long-term ALPHA P-III data showed danicopan with Ultomiris or Soliris sustained clinical benefits in PNH patients with significant extravascular hemolysis

15. Proprietary Name: Tremfya

Non-Proprietary Name: Guselkumab

Company: Janssen Pharmaceuticals (Johnson & Johnson)

First Approved: US (Jul 13, 2017), EU (Nov 10, 2017)

Total Revenue: $3.14B

Indications Approved: Moderate-to-severe plaque Psoriasis, Active Psoriatic Arthritis

- Tremfya is administered as a 100 mg subcutaneous injection every eight weeks, except the second dose given four weeks after the first to treat Moderate to Severe Plaque Psoriasis, and Psoriatic Arthritis in adults

- Tremfya inhibits a natural substance in the body called interleukin-23, which induces inflammation and edema

- In 2023, Tremfya generated 17.95% more revenue as compared to 2022, due to market growth. In May’23, the Tremfya P-III study showed positive data for inflammatory bowel in patients with moderately to severely active ulcerative colitis

14. Proprietary Name: Prolia

Non-Proprietary Name: Denosumab

Company: Amgen

First Approved: US (Jun 01, 2010), EU (May 26, 2010)

Total Revenue: $4.04B

Indications Approved: Breast cancer, Postmenopausal, Glucocorticoid-Induced Osteoporosis

- Prolia is a RANK ligand (RANKL) inhibitor prescribed in the form of a subcutaneous injection to treat Breast Cancer, Postmenopausal Osteoporosis, and Glucocorticoid-induced Osteoporosis

- Prolia binds to RANKL and prevents it from activating its receptor RANK on the surface of osteoclasts and their precursors. Prevention of the RANKL/RANK interaction inhibits osteoclast formation, function, and survival, thereby decreasing bone resorption and increasing bone mass and strength in both cortical and trabecular bone

- In 2023, Prolia’s revenue increased by 11.57 % vs. 2022, primarily driven by volume growth and high net selling price. In May’23 Amgen's Prolia in real-world evidence study showed a reduction in the risk of osteoporotic fractures compared to alendronate

13. Proprietary Name: Imfinzi

Non-Proprietary Name: Durvalumab

Company: AstraZeneca

First Approved: US (May 01, 2017), EU (Sep 21, 2018)

Total Revenue: $4.23

Indications Approved: Non-Small Cell Lung Cancer, Extensive-Stage Small Cell Lung Cancer, Locally Advanced or Metastatic Biliary Tract Cancer, Unresectable Hepatocellular Carcinoma

- Administered through an IV injection, Imfinzi is prescribed to treat Non-small Cell Lung Cancer, Extensive-stage Small Cell Lung Cancer, Locally Advanced or Metastatic Biliary Tract Cancer, and Unresectable Hepatocellular Carcinoma

- Imfinzi attaches to the protein PD-L1 i.e. located on the surface of cancer cells. After attaching it enhances the immune system's capacity to target cancer cells by binding to PD-L1 and blocking its effects, thereby slowing disease progression

- In 2023, Imfinzi’s revenue increased by 52.19% as compared to 2022, due to increased sales driven by new launches and established indications. In Feb’23, Imfinzi and Imjudo were approved in the EU for patients with advanced liver and non-small cell lung cancers

12. Proprietary Name: Perjeta

Non-Proprietary Name: Pertuzumab

Company: Roche

First Approved: US (Jun 08, 2012), EU (Mar 04, 2013)

Total Revenue: $4.47B

Indications Approved: HER2+ Metastatic Breast Cancer (MBC) and Inflammatory Disorders

- A humanized monoclonal antibody, Perjeta, is approved in the form of an IV injection to treat HER2+ metastatic breast cancer and inflammatory disorders

- Perjeta targets the extracellular dimerization domain (Subdomain II) of the HER2 protein and blocks ligand-dependent heterodimerization of HER2 and other HER family members, including EGFR, HER2, and HER4

- In 2023, Perjeta’s total sales increased by 1.29% vs. 2022, due to increased sales in the international region, mainly in China and Brazil

11. Proprietary Name: Hemlibra

Non-Proprietary Name: Emicizumab

Company: Roche

First Approved: US (Nov 16, 2017), EU (Feb 23, 2018)

Total Revenue: $4.92B

Indications Approved: Hemophilia A (Congenital Factor VIII Deficiency)

- Hemlibra is a bispecific factor IXa- and factor X-directed antibody. It is sold as an IV injection and prescribed to reduce the frequency of bleeding episodes in patients with Hemophilia A (congenital factor VIII deficiency) with or without factor VIII inhibitors

- Hemlibra bridges activated factor IX and factor X to restore the function of missing activated factor VIII required for effective hemostasis

- Hemlibra’s 2023 net sales rose by 19.18 % as compared to 2022, majorly due to higher sales in the US. In Dec’23, new data from the P-III (HAVEN 7) study showed the effectiveness of early preventative treatment with Hemlibra for babies with severe Hemophilia A

10. Proprietary Name: Cosentyx

Non-Proprietary Name: Secukinumab

Company: Novartis

First Approved: US (Jan 21, 2015), EU (Jan 14, 2015)

Total Revenue: $4.98B

Indications Approved: Plaque Psoriasis, Psoriatic Arthritis, Ankylosing Spondylitis, Non-Radiographic Axial Spondyloarthritis, Enthesitis-Related Arthritis, Hidradenitis Suppurativa

- A selective interleukin-17A (IL-17A) inhibitor, Cosentyx, is prescribed to treat Plaque Psoriasis, Ankylosing Spondylitis, Psoriatic Arthritis, Non-radiographic Axial Spondyloarthritis, and Enthesitis-related Arthritis

- Cosentyx is a human IgG1 monoclonal antibody and is marketed in the form of an IV injection. It selectively binds to the IL-17A cytokine and inhibits its interaction with the IL-17 receptor. Cosentyx inhibits the release of proinflammatory cytokines and chemokines

- In 2023, the revenue of Cosentyx went up by 4.01% vs 2022, due to increased demand growth across key regions. In Oct’23, Cosentyx IV formulation received the US FDA approval as an interleukin-17A antagonist for rheumatic diseases

9. Proprietary Name: Entyvio

Non-Proprietary Name: Vedolizumab

Company: Takeda

First Approved: US (May 20, 2014), EU (May 22, 2014)

Total Revenue: $5.49B

Indications Approved: Ulcerative Colitis and Crohn’s Disease

- An integrin receptor antagonist, Entyvio comes in the form of an IV injection, prescribed for the treatment of Crohn’s Disease and Ulcerative Colitis

- Entyvio is a humanized monoclonal antibody that specifically binds to the α4β7 integrin, blocks the interaction of α4β7 integrin with mucosal address cell adhesion molecule-1 (MAdCAM-1), and inhibits the migration of memory T-lymphocytes across the endothelium into inflamed gastrointestinal parenchymal tissue

- Entyvio’s 2023 revenue increased by 6.67% as compared to 2022 owing to the increased demand in the 1L biologic IBD population primarily in UC. In Sep’23, the US FDA approved SC Entyvio as maintenance therapy for ulcerative colitis

8. Proprietary Name: Ocrevus

Non-Proprietary Name: Ocrelizumab

Company: Roche

First Approved: US (Mar 28, 2017), EU (Jan 08, 2018)

Total Revenue: $7.58B

Indications Approved: Multiple Sclerosis and Relapsing-Remitting Disease

- A humanized monoclonal antibody, Ocrevus targets CD20-positive B cells, an immune cell type believed to have a significant contribution to Myelin and Axonal damage

- Marketed as an IV injection, Ocrevus is prescribed for both relapsing and primary progressive forms of multiple sclerosis. Ocrevus triggers antibody-dependent cellular cytolysis and complement-mediated lysis

- In 2023, the total sales of Ocrevus went up by 16.15% as compared to 2022, due to growing demand for the product in both indications. In Jul’23, Ocrevus evaluating in P-III (OCARINA II) study met its primary and secondary endpoints

7. Proprietary Name: Skyrizi

Non-Proprietary Name: Risankizumab

Company: AbbVie

First Approved: US (Apr 23, 2019, EU (Apr 26, 2019)

Total Revenue: $7.76B

Indications Approved: Plaque Psoriasis, Psoriatic Arthritis, Crohn's Disease, Ulcerative Colitis

- Skyrizi is an interleukin-23 (IL-23) inhibitor that selectively blocks IL-23 by binding it to its p19 subunit. IL-23 is a naturally occurring cytokine, involved in Inflammatory and Immune responses

- Marketed as an IV injection, Skyrizi is prescribed for Plaque Psoriasis, Psoriatic Arthritis, and Crohn’s disease

- In 2023, Skyrizi’s total sales increased by 50.3% compared to 2022, primarily driven by continued strong market share uptake and market growth across all indications. In Mar’23, SKYRIZI was evaluated in the P-III (INSPIRE) study and met primary and secondary points to treat ulcerative colitis

6. Proprietary Name: Opdivo

Non-Proprietary Name: Nivolumab

Company: Bristol-Myers Squibb

First Approved: US (Mar 4, 2015), EU (Jun 19, 2015)

Total Revenue: $9B

Indications Approved: Melanoma, Non-Small Cell Lung Cancer, Malignant Pleural Mesothelioma, Renal Cell Carcinoma, Classical Hodgkin Lymphoma, Squamous Cell Carcinoma of the Head and Neck, Urothelial Carcinoma, Colorectal Cancer, Hepatocellular Carcinoma, Esophageal Cancer, Gastric Cancer, Gastroesophageal Junction Cancer, and Esophageal Adenocarcinoma

- A PD-1 blocking antibody, Opdivo is approved to treat Melanoma, Non-small Cell Lung Cancer, Malignant Pleural Mesothelioma, Renal Cell Carcinoma, Classical Hodgkin Lymphoma, Head & Neck Cancer, and Urothelial Carcinoma, etc.

- Prescribed as an IV injection, this PD-1 immune checkpoint inhibitor controls the body’s immune system to help restore the anti-tumor immune response

- In 2023, Opdivo’s total sales increased by 9.21% as compared to 2022 owing to high demand in the US. In Dec’23, the US FDA accepted BMS’ priority review application for Opdivo + Cisplatin-based chemotherapy for 1L treatment of adult patients with unresectable or metastatic cancers

5. Proprietary Name: Darzalex

Non-Proprietary Name: Daratumumab

Company: Janssen Pharmaceuticals (Johnson & Johnson)

First Approved: US (Nov 16, 2015), EU (May 20, 2016)

Total Revenue: $9.74B

Indications Approved: Multiple Myeloma

- Darzalex is a human anti-CD38 monoclonal antibody prescribed for the treatment of Multiple Myeloma

- Darzalex binds to CD38 and causes cell apoptosis through antibody-dependent cellular cytotoxicity, complement-dependent toxicity, inhibition of mitochondrial transfer, or antibody-dependent cellular phagocytosis

- Darzalex’s 2023 revenue rose by 22.15% as compared to 2022, due to high sales reported globally. In Dec’23, The quadruplet therapy that includes DARZALEX FASPRO (daratumumab and hyaluronidase-fihj) demonstrated benefits in outcomes for patients with newly diagnosed multiple myeloma who are eligible for transplantation

4. Proprietary Name: Stelara

Non-Proprietary Name: Ustekinumab

Company: Janssen Pharmaceutical (Johnson & Johnson)

First Approved: US (Sep 25, 2009), EU (Jan 15, 2009)

Total Revenue: $10.85B

Indications Approved: Plaque Psoriasis, Crohn’s Disease, Psoriatic Arthritis, Ulcerative colitis

- Administered through an IV injection, Stelara is prescribed to treat Plaque Psoriasis, Psoriatic Arthritis, Crohn’s Disease, and Ulcerative Colitis

- Stelara is a human interleukin-12 (IL-12) and interleukin-23 (IL-23) that selectively inhibits the IL-12 and IL-23 pathways

- As compared to 2022, Stelara’s 2023 revenue increased by 11.67% driven by patient mix, market growth, and continued strength in IBD. In Mar’23, new long-term data for Stelara proved the safety profile in IBD and demonstrated lasting efficacy in ulcerative colitis

3. Proprietary Name: Dupixent

Non-Proprietary Name: Dupilumab

Company: Sanofi

First Approved: US (Mar 28, 2017), EU (Sep 26, 2017)

Total Revenue: $11.82B

Indications Approved: Atopic Dermatitis, Asthma, Chronic Rhinosinusitis with Nasal Polyposis, Eosinophilic Esophagitis, Prurigo Nodularis

- A monoclonal antibody, Dupixent, is prescribed as a subcutaneous injection to treat multiple indications, including Atopic Dermatitis, Asthma, Eosinophilic Esophagitis, etc.

- Dupixent is available as a single-dose pre-filled pen along with a single-dose pre-filled syringe. Dupixent inhibits the signalling of the IL-4 and IL-13 pathways

- Dupixent’s revenue in 2023 increased by 32.89% as compared to 2022, due to higher sales in Europe and the United States. In Nov’23, Dupixent second positive P-III study showed decreased COPD exacerbations

2. Proprietary Name: Humira

Non-Proprietary Name: Adalimumab

Company: AbbVie

First Approved: US (Dec 31, 2002), EU (Sep 8, 2003)

Total Revenue: $14.4B

Indications Approved: Rheumatoid Arthritis, Juvenile Idiopathic Arthritis, Psoriatic Arthritis, Ankylosing Spondylitis, Crohn’s Disease, Ulcerative Colitis, Plaque Psoriasis, Hidradenitis Suppurativa, Uveitis

- Humira is prescribed as a subcutaneous injection to treat Rheumatoid Arthritis, Juvenile Idiopathic Arthritis, Psoriatic Arthritis, Ankylosing Spondylitis, Crohn's Disease, Ulcerative Colitis, Plaque Psoriasis, Hidradenitis Suppurativa, and Uveitis

- Humira is a tumor necrosis factor (TNF) blocker that reduces inflammation by targeting and blocking TNF-α

- Humira’s 2023 revenue showed a decline of 32.17% as compared to 2022, primarily driven by direct biosimilar competition following the loss of exclusivity on January 31, 2023. In Jan’23 Amgen launched the first Humira biosimilar Amjevita in the US

1. Proprietary Name: Keytruda

Non-Proprietary Name: Pembrolizumab

Company: Merck & Co.

First Approved: US (Sep 04, 2014), EU (Jul 17, 2015)

Total Revenue: $25.01B

Indications Approved: Melanoma, Non-Small Cell Lung Cancer, Head and Neck Squamous Cell Cancer, Classical Hodgkin Lymphoma, Primary Mediastinal Large B-cell lymphoma, Endometrial Carcinoma, Tumor Mutational Burden-High (TMB-H) Cancer, Cutaneous Squamous Cell Carcinoma, Triple-Negative Breast Cancer, Gastric Cancer, Esophageal Cancer, Cervical Cancer, Hepatocellular Carcinoma, Merkel Cell Carcinoma, Renal Cell Carcinoma, Biliary Tract Cancer, etc.

- Keytruda is a human PD-1 blocking antibody indicated to treat patients with Melanoma, Non-small Cell Lung Cancer, Head, Neck Squamous Cell Cancer Classical Hodgkin Lymphoma, and more

- Keytruda, a humanized monoclonal antibody that acts against these indications by blocking the interaction between PD-1 and its ligands (PD-L1 and PD-L2), which activates T-lymphocytes that may affect both the tumor cells and healthy cells

- In 2023, Keytruda’s net sales rose by 19.45% compared to 2022 due to increased demand from new global indications and ongoing uptake in current ones. In Dec’23, the US FDA approved an extended indication for Keytruda + Padcev for the 1L treatment of adult patients with locally advanced or metastatic urothelial carcinoma

Sources:

- Annual reports

- SEC Filings

- Press releases

- Company websites

Currency Conversion: X-Rates

Note: Percentage Change in Segment Revenue is calculated on precise value in Millions

Related Post: Top 20 Monoclonal Antibodies Based on 2022 Total Revenue

Tags

An avid reader and a dedicated learner, Prince works as a Content Writer at PharmaShots. Prince possesses an exceptional quality of breaking down the barriers of words by simplifying the terms in digestible chunks to make content readable and comprehensible. Prince likes to read books and loves to spend his free time learning and upskilling himself.