Know Your Investor: F-Prime Capital Partners

Shots:

- PharmaShots' tertiary report on the Know Your Investor Section features F-Prime Capital Partners. Know Your Investor is an earnest effort from PharmaShots to acquaint our readers with leading Investors and venture capital firms in the healthcare industry

- Founded in 1969, F-Prime Capital Partners is a subsidiary of Fidelity Investments and primarily invests in healthcare and technology

- In 2022, F-Prime closed around 34 investments in biopharma companies, devices, diagnostics, and manufacturing, among others

F-Prime Capital Partners

A subsidiary of Fidelity Investments, F-Prime Capital Partners holds a significant presence in the venture capital and private equity industry by steadfastly invests in healthcare and technology. Established in 1969, F-Prime is based in Cambridge Massachusetts and operates predominantly in North America and Europe. To facilitate overseas investments, F-Prime collaborates with Eight Roads with their sister funds in London, Shanghai, Beijing, Hong Kong, Tokyo, and Mumbai.

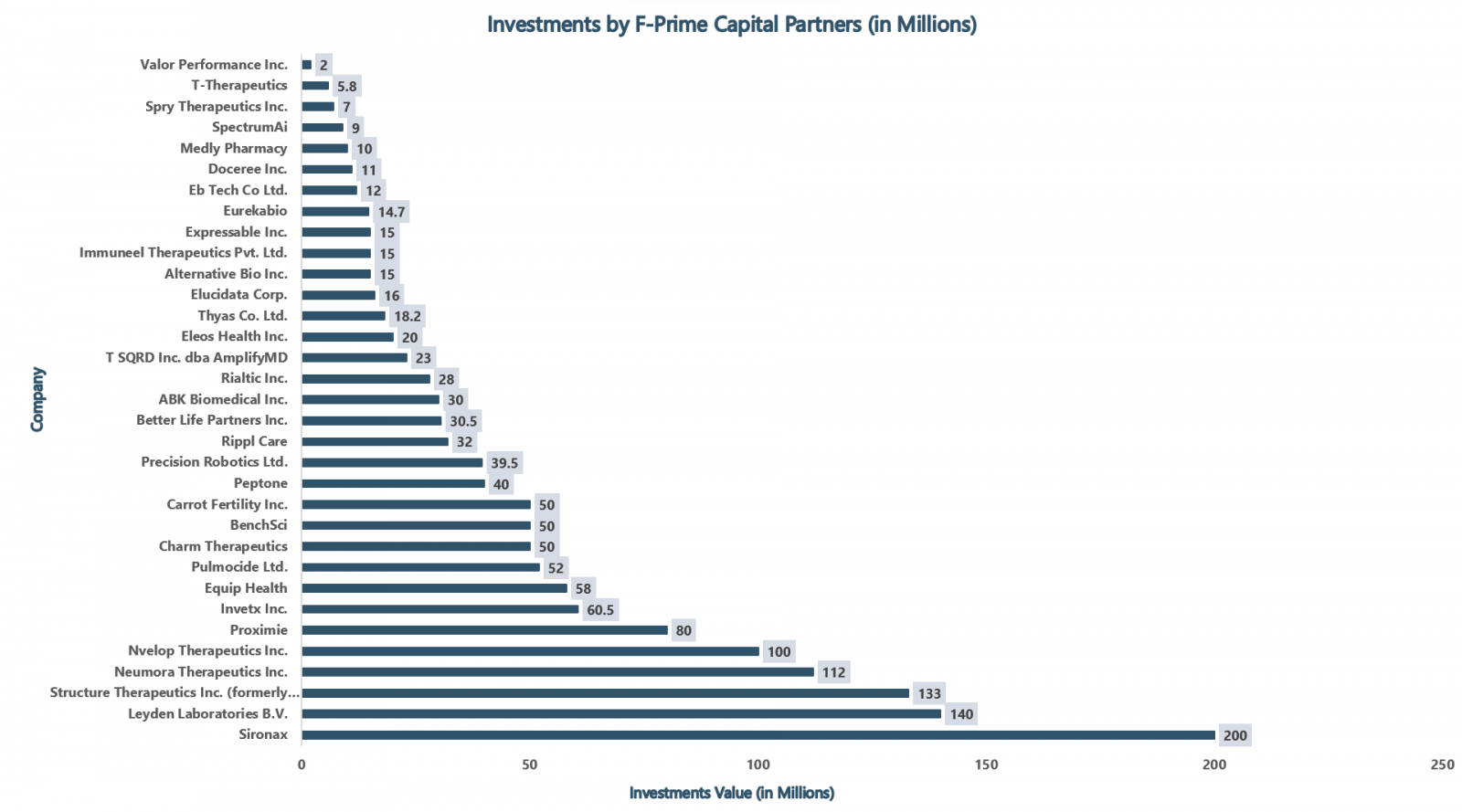

F-Prime Capital is majorly associated with investments made in Seed, Series A, B, C, and D rounds. Abelian Therapeutics, ABK Biomedical, Acacia Pharma, Accuri Cytometers, Adagene, Airespace, and Aclaris are among F-Prime’s portfolio companies. To date, F-Prime Capital Partners has made over ~200 investments in the field of Life Sciences and Healthcare. In 2022, Sironax received the highest amount of funding, worth $200M.

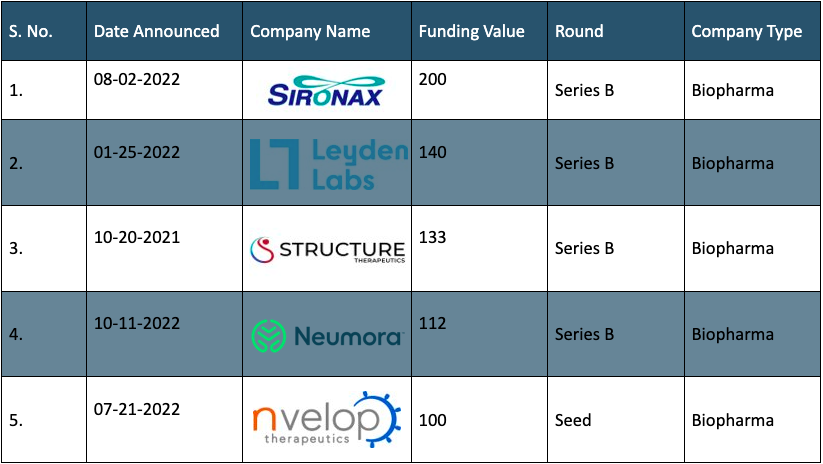

In 2022, around 34 investments were closed in by F-Prime Capital Partners, primarily in Biopharmaceutical companies, Devices, Diagnostics, Manufacturing, or Service Providers, among others. Oncology, cardiology, genitourinary, infectious diseases, inflammation, neurological conditions, and pulmonary diseases were areas of emphasis for the investments. F-Prime Capital Partners invested in diverse technologies, including Artificial Intelligence (AI), Machine Learning (ML), Cell Therapy, Devices, Diagnostics, Digital Health, Gene Editing/CRISPR, Protein-based therapies, RNA-based therapies, Small Molecules, Stem Cells, etc. Additionally, 38% of F-Prime Capital Partners’ total investments in 2022 were made under Series A, whereas 26% were made under Series B. The top 3 investments made by F-Prime Capital Partners were:

- Series B funding worth $200M to Sironax

- Series B funding worth $140M to Leyden Laboratories B.V.

- Series B funding worth $133M to Structure Therapeutics

In the first quarter of 2022, F-Prime participated in 13 funding rounds, 10 in the second, 7 in the third, and, 2 in the fourth quarter. Manufacturing and Services companies like Rippl Care, Elucidata Corp., Better Life Partners Inc., and Eurekabio, received major investments from F-Prime. F-Prime Capital Partners invested in several Biopharma companies like Alternative Bio, Neumora Therapeutics, Sironax, Nvelop Therapeutics, etc.

F-Prime invested heavily in companies developing therapies by leveraging artificial intelligence (AI) and machine learning (ML). Proximie received a total of $80 million from F-Prime Capital Partners, while BenchSci earned $50M, Peptone $40M, Eleos Health $20M, and Spry Therapeutics $ 7M.

The table below showcases the top 5 funding rounds out of the 34 investments made by F-Prime Capital Partners in 2022. (For a complete report, reach out to us at connect@pharmashots.com with the subject line "F-Prime Capital Partners Data")

Related Posts: Know Your Investor: RA Capital Management LLC

Tags

Shivani was a content writer at PharmaShots. She has a keen interest in recent innovations in the life sciences industry. She was covering news related to Product approvals, clinical trial results, and updates. We can be contacted at connect@pharmashots.com.