Top Performing Drug of 2021 - Humira (April Edition)

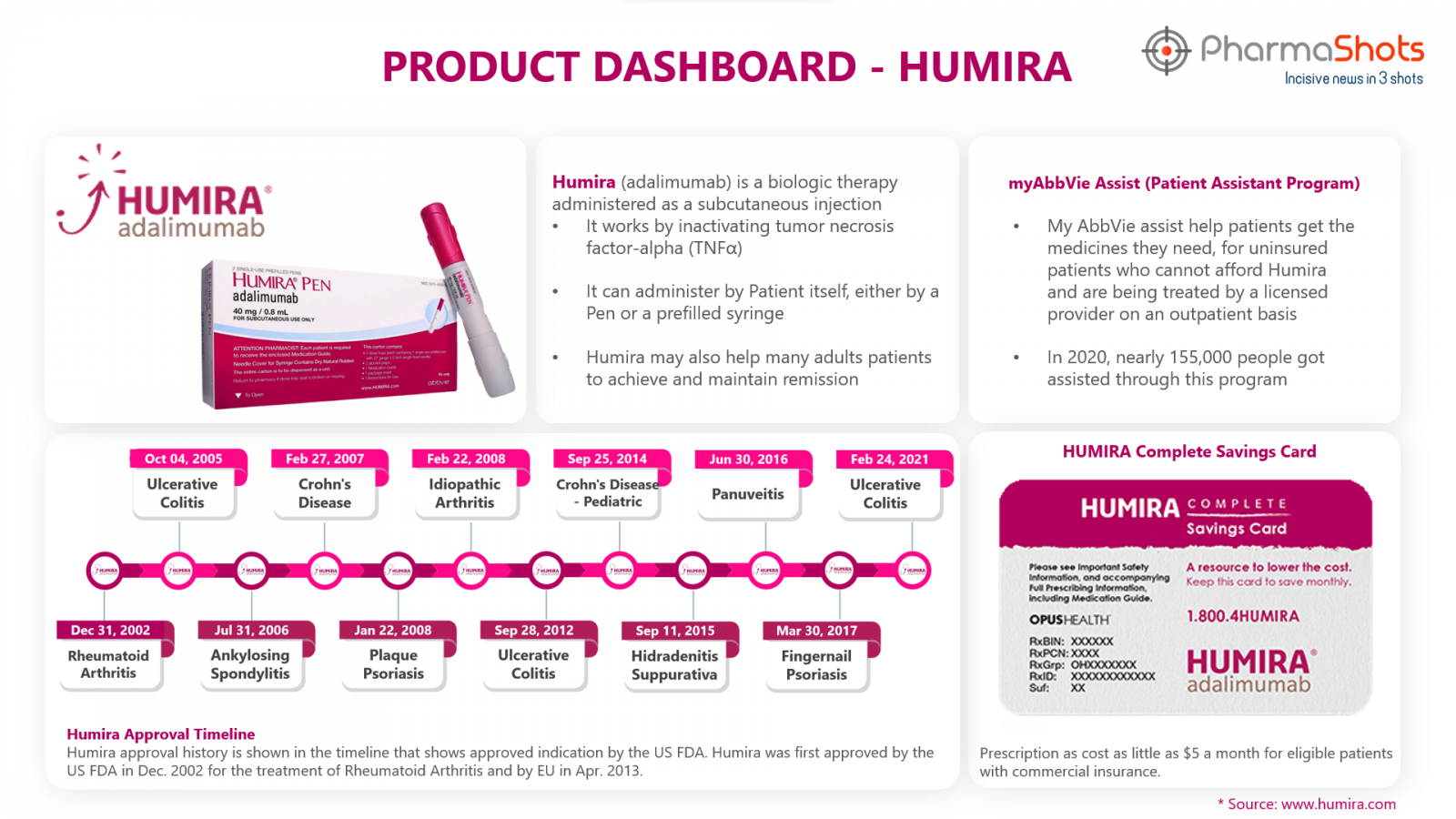

Active Ingredients: Adalimumab

Strength: 40 mg/0.8 ml

Dosage Form: Syringe, Vial

Mechanism of Action: TNF-alpha inhibitors

First Approval: US (Dec 31, 2002), EU (Aug 09, 2003)

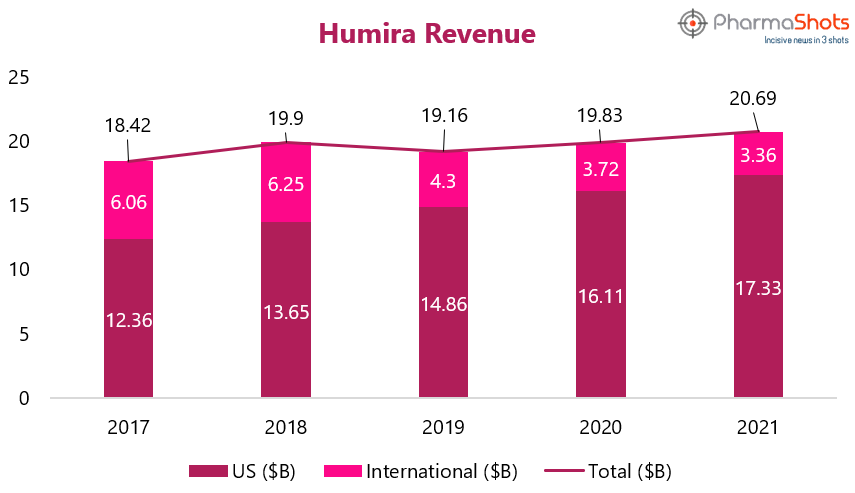

Revenue

Humira (adalimumab) has been the top-selling biologic drug product for the last few years – reaching nearly $21B in annual sales in 2021. Humira is one of the main drivers of AbbVie’s immunology revenue growth. It brought approximately 37% of AbbVie's total net revenues in 2021, 43% in 2020, and 58% in 2019. Humira sales continued to increase over the last five years, with an increase of 4% in 2021 despite facing direct biosimilar competition in Europe and other countries. But we can expect the diminishing sales in future as the adoption of adalimumab biosimilars increases in Europe and Humira’s patent protection is lost in the US come 20233. Let’s see in what manner the revenue of Humira changes over the last five years.1

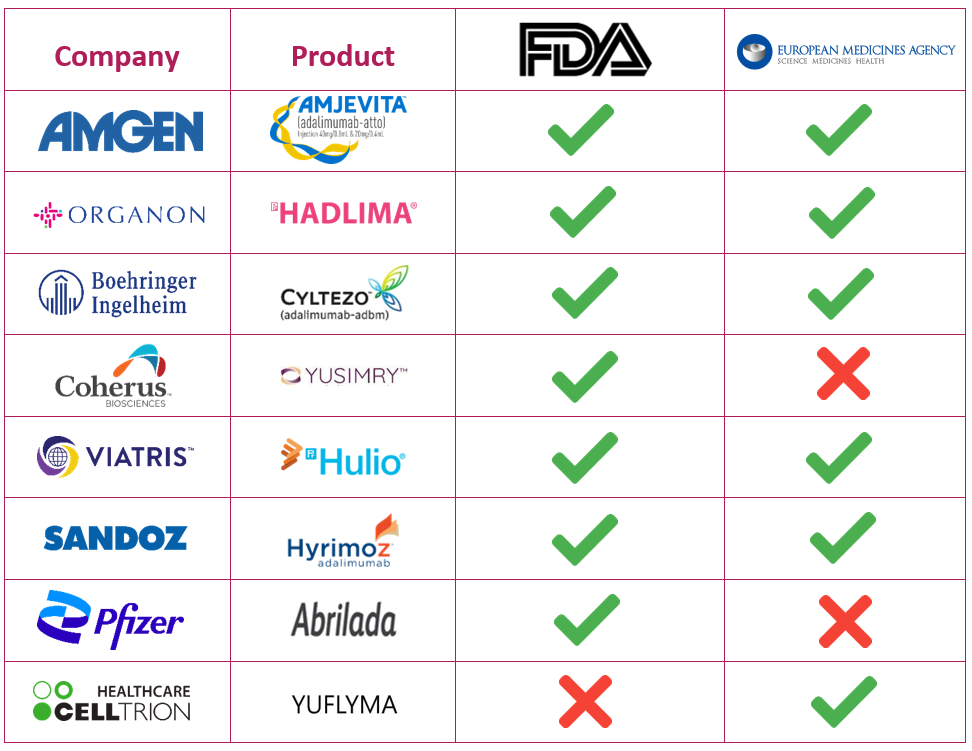

Biosimilars of Humira

Humira is already facing competition from biosimilars in EU and other countries. Hence, we need to talk about the biosimilar competition that Humira is facing and will be facing in the US. Market is ready to boom in the year 2023 as Humira is close to the expiration of its exclusivity. Currently, there aren't any biosimilars to Humira launched in US market, although 7 have been approved by the FDA with its expected entry in the market in 20234. Some of its approved biosimilars include 5

Approved Indications for Humira

Humira is approved and marketed in the US and Europe for various indications including6:

- Rheumatoid Arthritis: Moderately to severely active rheumatoid arthritis.

- Juvenile Idiopathic Arthritis: Moderately to severely active polyarticular juvenile idiopathic arthritis in patients 2 years of age and older, alone or in combination with methotrexate.

- Psoriatic Arthritis: Inhibits the progression of structural damage that improves physical function in adult patients with active psoriatic arthritis, alone or in combination with non-biologic DMARDs.

- Ankylosing Spondylitis: Reduces signs and symptoms in adult patients with active ankylosing spondylitis.

- Crohn’s Disease: Moderately to severely active Crohn’s disease in adults and paediatric patients 6 years of age and older.

- Ulcerative Colitis: Moderately to severely active ulcerative colitis in adults and paediatric patients 5 years of age and older.

- Plaque Psoriasis: Adult patients with moderate to severe chronic plaque psoriasis

- Hidradenitis Suppurativa: Moderate to severe hidradenitis suppurativa in patients 12 years of age and older.

- Uveitis: Non-infectious intermediate, posterior, and panuveitis in adults and paediatric patients 2 years of age and older.

Note: Humira is also approved in Japan for the treatment of intestinal Behçet's disease and pyoderma gangrenosum1.

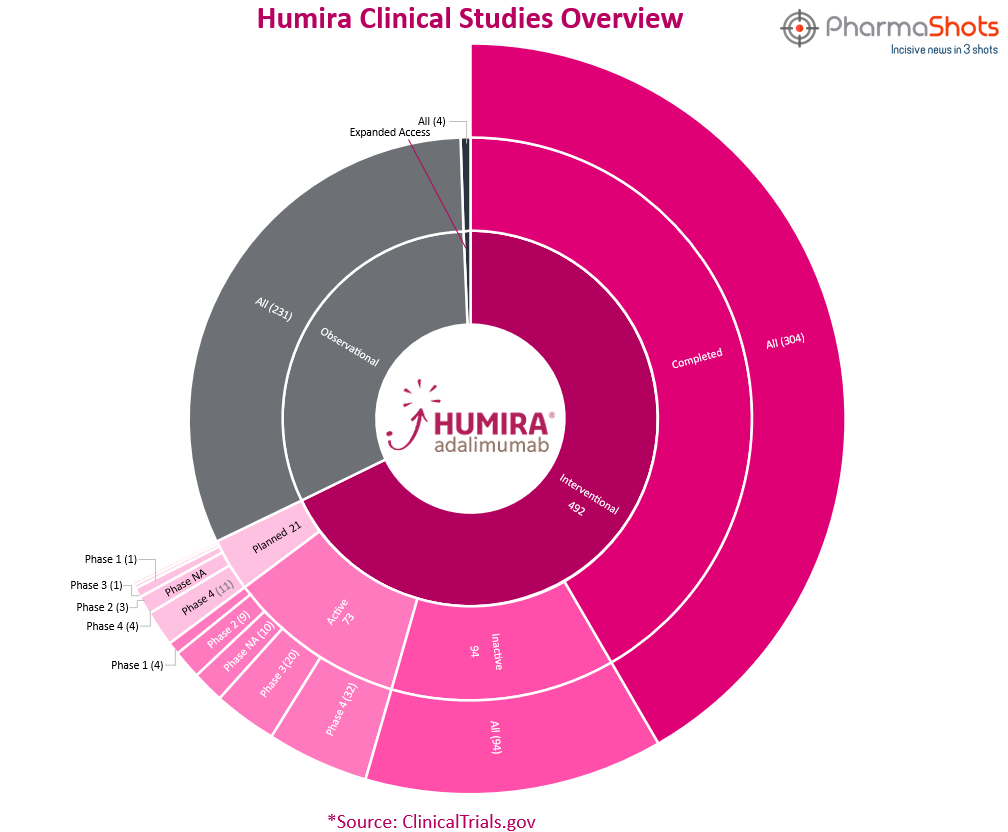

Clinical Trials

Humira has total 727 trials which includes 492 interventional, 231 observational & 4 expanded access trials. From the analysis of clinical trials, we have made a representation for the trials of Humira.

*Active trials include Recruiting; Active, Not Recruiting, and Enrolling by Invitation

*Inactive trials include Terminated; Withdrawn; Unknown Status

Please visit cost and copay section on www.humira.com and patient assistance section on www.abbvie.com for more information11

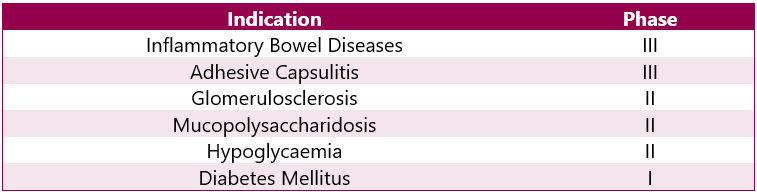

Humira Pipeline Analysis

Various trials are ongoing for other indications. This can be categorised as follows:

Other Information:

Every company relies on patent, trademark and other intellectual property protection in the discovery, development, manufacturing and sale of its products. Patented products provide market exclusivity and profitability to the company. For AbbVie, Humira’s patents are very vital to the company’s business as a whole.

The United States composition of matter patent that covers adalimumab expired in December, 2016, and the equivalent European Union patent expired in October 2018. In the US, non-composition of matter patents of adalimumab is to be expired in 2022 for which the company has entered into settlement and license agreements with several adalimumab biosimilar manufactures. Under the agreements, the licenses in the United States will begin in 2023 and the licenses in Europe began in 2018.1

The expiration or loss of patent protection and licenses may adversely affect AbbVie's future revenues and operating earnings.

References:

- https://investors.abbvie.com/static-files/3a31715e-5d44-47a2-b25b-b1ec284493d0

- https://d18rn0p25nwr6d.cloudfront.net/CIK-0000064978/adb74fbd-102d-4352-8aa7-d24d7159858e.pdf

- https://www.sciencedirect.com/science/article/abs/pii/S0022354921000800

- https://www.managedhealthcareexecutive.com/view/when-humira-finally-faces-biosimilar-competition-losses-to-abbvie-may-not-be-as-steep-as-expected-says-analyst-report

- https://www.cardinalhealth.com/en/product-solutions/pharmaceutical-products/biosimilars/humira-biosimilar-landscape-overview.html

- https://www.rxabbvie.com/pdf/humira.pdf?_ga=2.171280547.284600700.1650260933-1630474018.1632284211

- https://clinicaltrials.gov/ct2/show/NCT04404517

- https://clinicaltrials.gov/ct2/show/NCT05299242

- https://clinicaltrials.gov/ct2/show/NCT04009668

- https://clinicaltrials.gov/ct2/show/NCT02586831

- https://www.humira.com/

- https://www.drugs.com/history/humira.html

- https://clinicaltrials.gov/ct2/show/NCT03153319

- https://clinicaltrials.gov/ct2/show/NCT02586831

Tags

This content piece was prepared by our former Senior Editor. She had expertise in life science research and was an avid reader. For any query reach out to us at connect@pharmashots.com