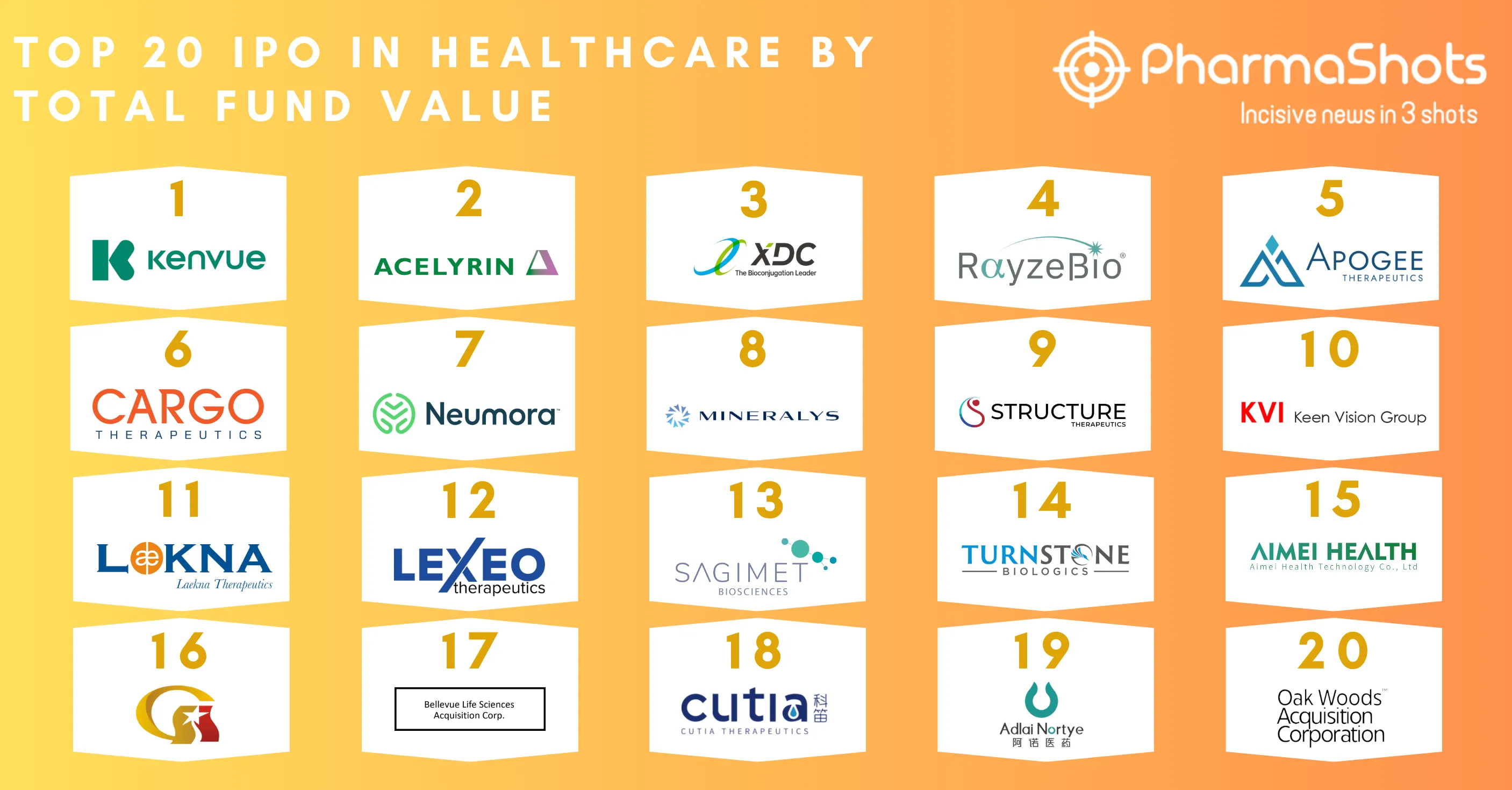

Top 20 IPOs in Healthcare by Total Fund Value

Shots:

- Immutable capital demands and high-spending drug development plans are the most common drivers in encouraging fully-fledged private healthcare companies to go public. Apart from the exposure and capital raise, companies gain more recognition, credibility, and indispensable value assessment

- 2022 had been a great year when it comes to the IPOs of healthcare companies. Bausch + Lomb efficaciously emerged as a top-grade performer with a total IPO value of $711M, followed by HilleVax and Third Harmonic Bio

- With the invaluable insights of DealForma, PharmaShots has prepared a detailed report on the Top 20 IPOs in the Healthcare industry of the year 2022

Funding Value: $6.3M

Founded Year: 2007

No. of Shares: 1.5M

Total Employees: 13

IPO Announced Date: May 17, 2022

Headquarters: Texas, US

IPO Date: Jun 15, 2022

Stock Exchange: NASDAQ

HeartSciences is a medical technology company focused on bridging the “diagnostic gap” in cardiac care by applying innovative AI-based technology to an EKG (also called ECG) to advance the field of ECG. MyoVista wavECG is the company’s first FDA-cleared product which is designed to provide diagnostic information related to cardiac dysfunction in addition to being a resting 12-lead ECG. The company bagged its $6.3M IPO in Jun’22 offering shares at $4.25/unit.

Funding Value: $7M

No. of Shares: 1.2M

IPO Announced Date: Sep 29, 2022

IPO Date: Dec 19, 2022

Founded Year: 2005

Total Employees: 5

Headquarters: Pennsylvania, US

Stock Exchange: NASDAQ

Lipella is a biotech company that reformulates and optimizes active agents in existing generic drugs for the development of new drugs. The company is focused on supportive care for cancer survivors with acquired haemorrhagic cystitis (radiation cystitis) with lead candidate LP-10 recently completing P-IIA multi-center dose-escalation study. LP-310, another lead asset of the company received FDA Type-B Pre-IND guidance recently for Oral Lichen Planus. The company went on to close its IPO in Dec’22, raising $7M from the sale of its stocks at $5.75/share.

Funding Value: $7.7M

No. of Shares: 1.3M

IPO Announced Date: Mar 18, 2022

IPO Date: Jul 20, 2022

Founded Year: 2021

Total Employees: 6

Headquarters: London, UK

Stock Exchange: NASDAQ

Virax is a global biotech company primarily engaged in the sale, distribution, and marketing of diagnostic test kits and med-tech and PPE products for the detection and diagnosis of viral diseases. The company’s product portfolio comprises two platforms: Virax Immune, a new-Covid-19 test detecting the T-Cell immune response to the SARS-Cov-2 virus and ViraxClear, a platform to sell a range of highly accurate diagnostic test kits and machines. Around mid-2022, the company anticipated a $6.75M IPO with a price of shares set at $5. The company ended up pulling in nearly $7.7M in its IPO.

Funding Value: $7.8M

No. of Shares: 1.2M

IPO Announced Date: Mar 18, 2022

IPO Date: Jul 20, 2022

Founded Year: 2021

Total Employees: 14

Headquarters: London, UK

Stock Exchange: NASDAQ

bioAffinity is a diagnostic company focused on the development of non-invasive, early-stage cancer diagnosis and targeted cancer treatment. CyPath Lung is the company’s first product which is a non-invasive and accurate test to detect early-stage lung cancer. In Jul’22 the company offered 1.3M units at the price of $6.125/share, each unit included one common stock, one tradable warrant exercised at $7.35/share and one non-tradable warrant exercised at $7.656/share. In Sep’22 stakeholders exercised 0.7M tradable warrants and 0.3M non-tradable warrants for the gross proceeds of $7.7M. At the closure, the company gained a total amount of $15.6M.

Funding Value: $9.4M

No. of Shares: 2.1M

IPO Announced Date: Jan 06, 2022

IPO Date: Apr 21, 2022

Founded Year: 2008

Total Employees: 6

Headquarters: California, US

Stock Exchange: NASDAQ

Aclarion is a healthcare technology company delivering SaaS solutions using Magnetic Resonance Spectroscopy (“MRS”) and proprietary biomarkers to aid patients suffering from chronic lower back pain. Using its technology, the company has developed NOCISCAN, the first evidence-supported SaaS platform to help physicians differentiate painful and nonpainful discs in the spine by providing critical pain biomarker data along with MRI scans. The company went public in Apr’22 at a public offering price of $4.35 per unit.

Funding Value: $9.6M

No. of Shares: 1.2M

IPO Announced Date: Jan 04, 2022

IPO Date: Sep 15, 2022

Founded Year: 2010

Total Employees: 3

Headquarters: Texas, US

Stock Exchange: NASDAQ

Nexilin Technology is developing neurostimulation products to combat the global mental health epidemic. Nexilin has developed an advanced waveform technology known as Generation 2 or Gen 2 emitted at 15mA with the ability to penetrate deeper into the brain and associated structures of mental illness. A series of agreements were made between Nexalin and Wider Come Limited in Sep’18 to form a joint venture entity in Hong Kong to enhance their clinical research and medical device distribution in China, Macau, Hong Kong, and Taiwan. In Sep’22, the company completed its IPO with each share of common stock sold at an offering price of $4.15/share.

Funding Value: $11.4M

No. of Shares: 1.2M

IPO Announced Date: Jun 03, 2022

IPO Date: Aug 30, 2022

Founded Year: 2012

Total Employees: 6

Headquarters: Maryland, USA

Stock Exchange: NASDAQ

Shuttle is a discovery and development stage specialty pharma company designing first-in-class therapies to cure cancer and improve radiation therapy outcomes. The company comprises one lead clinical-stage product, Ropidoxuridine (IPdR) for glioblastoma and sarcoma. Shuttle originally planned for a $9.9M IPO selling shares at $8.125/share in Aug’22 but it shot far higher, nabbing $11.4M at the end.

Funding Value: $11.5M

No. of Shares: 1.2M

IPO Announced Date: Apr 11, 2022

IPO Date: Jul 27, 2022

Founded Year: 2018

Total Employees: 12

Headquarters: Illinois, US

Stock Exchange: NYSE

MAIA Biotechnology is a targeted therapy, immune-oncology company focused on developing targeted cancer drugs. The lead program of the company, THIO, is an investigational dual mechanism of action drug incorporating telomere targeting and immunogenicity in patients with NSCLC. Around 4 months after the announcement, though the company initially planned to raise up to $10M in its IPO by selling its stock at $5/share but ended up with the sum of $11.5M.

Funding Value: $15.2M

No. of Shares: 3M

IPO Announced Date: Nov 18, 2022

IPO Date: Dec 29, 2022

Founded Year: 2020

Total Employees: 6

Headquarters: Texas, US

Stock Exchange: NASDAQ

Coya is a clinical-stage biotech company developing regulatory T-cell (Treg) therapies for neurodegenerative, autoimmune, and metabolic diseases. The company’s sole clinical-stage candidate, COYA 101, has completed two IITs – P-I and P-IIa for the treatment of Amyotrophic Lateral Sclerosis (ALS). Coya offered 3M shares at $5/share raising $15.2M upon closure. In addition, the company has granted a 30-day option to purchase 0.2M common stock shares and 0.1M warrants.

Funding Value: $15.9M

No. of Shares: 1.2M

IPO Announced Date: Mar 18, 2022

IPO Date: Apr 13, 2022

Founded Year: 2007

Total Employees: 3

Headquarters: New York, US

Stock Exchange: NASDAQ

Sharps Technology is a medical device company aimed at engineering a safer future for healthcare providers and people everywhere via compassionate innovation. The Company's premier line of smart safety syringes, Sharps Provensa, prevents accidental needlestick injuries, prevents needle reuse, and minimizes drug and vaccine waste—all while maintaining the intuitive simplicity of conventional syringes. In Apr’22 the company completed its IPO with one share of the common stocks sold at $4.25.

Funding Value: $16M

No. of Shares: 4M

IPO Announced Date: Jan 31, 2022

IPO Date: Mar 14, 2022

Founded Year: 2021

Total Employees: 173

Headquarters: London, UK

Stock Exchange: NASDAQ

Akanda is a medical cannabis and wellness platform company with growing facilities in South Africa. The company cultivates, manufactures, and distributes cannabis to wholesalers in international markets. In late 2021, in exchange for roughly two-thirds of its stocks, the company acquired the international operations of Toronto-listed Halo Collective (NEO: HALO). Akanda’s portfolio includes Holigen (a Portugal-based cultivator, manufacturer, and distributor) and CanMart (a UK-based fully licensed pharma importer and distributor). In Mar’22, the company nabbed a $16M IPO at a price of $4/share.

Funding Value: $40.6M

No. of Shares: 6.7M

IPO Announced Date: Apr 05, 2022

IPO Date: Apr 29, 2022

Founded Year: 2016

Total Employees: 12

Headquarters: California, US

Stock Exchange: NASDAQ

Belite Bio is a clinical-stage biopharma company targeting presently untreatable eye diseases like Atrophic Age-related Macular Degeneration (dry AMD) and autosomal recessive Stargardt disease (STGD1), and metabolic diseases such as Non-Alcoholic Fatty Liver disease, Non-Alcoholic Steatohepatitis, Type 2 Diabetes, and Gout. The company’s lead candidate, LBS-008, is in its P-III trial as an oral treatment for STGD1. It has also been granted RPD and FTD designation in the US and has obtained Orphan Drug Designation in both US and Europe. Belite anticipated raising up to $36M by offering its shares at $6/share in Apr’22 and ended up with a hike in the fund value to $40.6M on closure.

Funding Value: $69M

No. of Shares: 4.6M

IPO Announced Date: Mar 04, 2022

IPO Date: Mar 24, 2022

Founded Year: 2017

Total Employees: 27

Headquarters: California, US

Stock Exchange: NASDAQ

AN2 Therapeutics is a clinical-stage biopharma company focused on developing therapies for rare, chronic, and serious infectious diseases. Epetraborole is the company’s in-licensed once-daily oral treatment for chronic non-tuberculosis mycobacterial (NTM) lung disease patients. The drug is under development in a pivotal P-II/III clinical trial. After around three weeks from the date of the announcement, the company went on to close its IPO, raising $69M from 4.6M shares at a public offering price of $15/share.

Funding Value: $107.3M

No. of Shares: 8.5M

IPO Announced Date: Oct 17, 2022

IPO Date: Nov 14, 2022

Founded Year: 2018

Total Employees: 39

Headquarters: Massachusetts, US

Stock Exchange: NASDAQ

Acrivon is a clinical-stage biopharma company developing drug-specific OncoSignature companion diagnostics utilizing its proteomics-based patient responder identification platform, Acrivon Predictive Precision Proteomics, or AP3. The company is advancing its lead product ACR-368 (Prexasertib) in a P-II trial for the treatment of platinum-resistant ovarian, endometrial, and bladder cancers. Initially pricing its IPO at $99.4M in Nov’22 with each stock sold for $12.5/share, the company ended up securing a $107.3M IPO.

Funding Value: $122.9M

No. of Shares: 10.2M

IPO Announced Date: Apr 15, 2022

IPO Date: May 05, 2022

Founded Year: 2018

Total Employees: 40

Headquarters: Massachusetts, US

Stock Exchange: NASDAQ

PepGen is a biopharma company that is using its proprietary Enhanced Delivery Oligonucleotide (EDO) platform to develop disease-modifying peptide-conjugated oligonucleotide candidates for severe neuromuscular and neurological diseases. The company comprises 5 lead programs in its pipeline targeting Duchenne muscular dystrophy (DMD) and myotonic dystrophy type 1 (DM1). PepGen pulled in $122.9M in gross proceeds in its IPO selling shares at $12/share.

Funding Value: $142.3M

No. of Shares: 9.4M

IPO Announced Date: Jan 14, 2022

IPO Date: Feb 04, 2022

Founded Year: 2014

Total Employees: 78

Headquarters: Maryland, US

Stock Exchange: NASDAQ

Arcellx is a clinical-stage biopharma company, reimagining cell therapy by developing immunotherapies for patients with cancer and other incurable diseases. CART-ddBCMA is the lead asset of the company and is in P-II development for the treatment of relapsed or refractory multiple myeloma (r/r MM) and has received Fast Track, Orphan Drug, and Regenerative Medicine Advanced Therapy designations by the US FDA. The company offered an IPO in Jan’22 and went to the public market in Feb’22 with a proposal to raise $123.8M at a public offering price of $15/share. On closing, the company received $142.3M in gross proceeds.

Funding Value: $199.2M

No. of Shares: 11.7M

IPO Announced Date: Sep 23, 2022

IPO Date: Oct 19, 2022

Founded Year: 2019

Total Employees: 158

Headquarters: Massachusetts, US

Stock Exchange: NASDAQ

Prime Medicine is a biotech company deploying its Prime Editing technology to deliver a new class of differentiated, one-time, curative genetic therapies. The company currently includes 18 preclinical programs in its pipeline for a wide spectrum of diseases like Duchenne Muscular Dystrophy, Cystic Fibrosis, Sickle-Cell Disease, Non-Symptomatic Hearing Loss, Neuro-Muscular conditions, and various liver diseases. The company planned to go public in Sep’22 and initially priced its IPO in Oct’22 at $17/share with $175M gross proceeds. The IPO ended up pulling in nearly $199.2M.

Funding Value: $213.1M

No. of Shares: 12.5M

IPO Announced Date: Aug 23, 2022

IPO Date: Sep 14, 2022

Founded Year: 2019

Total Employees: 22

Headquarters: California, US

Stock Exchange: NASDAQ

Third Harmonic Bio is a clinical-stage biopharma company focused on the advancement of medicines for allergy and inflammation diseases including respiratory, gastrointestinal, and dermal diseases. THB001, the lead asset of the company, is currently being evaluated in a P-Ib proof-of-concept trial for chronic inducible urticaria as a highly selective, oral small-molecule inhibitor of KIT. Two months after announcing the IPO, in Sep’22 the company initially priced it at gross proceeds of $185.3M at $17/share, which upon closure was raised up to $213.1M.

Funding Value: $230M

No. of Shares: 13.5M

IPO Announced Date: Apr 06, 2022

IPO Date: Apr 28, 2022

Founded Year: 2019

Total Employees: 31

Headquarters: Massachusetts, US

Stock Exchange: NASDAQ

Hillevax is a biopharma company that develops and commercializes novel vaccines benefiting human health globally. With an aim to develop a VLP-based vaccine candidate, Frazier and Takeda Pharmaceuticals underwent a collaboration to form Hillevax. HIL-214 (VLP-based vaccine candidate) to prevent moderate-to-severe acute gastroenteritis caused by norovirus infection is the lead product of the company. Offering shares of its common stock at $17/share, the company ended up raising an IPO worth $230M.

Funding Value: $711.9M

No. of Shares: 39.5M

IPO Announced Date: Jan 13, 2022

IPO Date: May 05, 2022

Founded Year: 1853

Total Employees: 12,800

Headquarters: Quebec, Canada

Stock Exchange: NYSE

Bausch + Lomb is a leading healthcare company focused on the Ophthalmology business of its parent company Bausch Health. The company has a presence in over 100 countries, working on a comprehensive pipeline comprising 400+ products which include contact lenses, lens care products, eye care products, ophthalmic pharmaceuticals, OTC products, and ophthalmic surgical devices and instruments. In May’22, Bausch + Lomb Corporation raised $630M in gross proceeds in its IPO at a public offering price of $18/share. In Jun’22, the company nabbed upsized IPO worth $711.9M bringing it to the top of the list for healthcare IPOs in 2022.

Sources:

- Annual reports

- SEC filings

- Press releases

- Company websites

Note:

- All revenues are reported in $M

- The companies included have initiated and completed the IPOs in 2022 via NASDAQ and NYSE

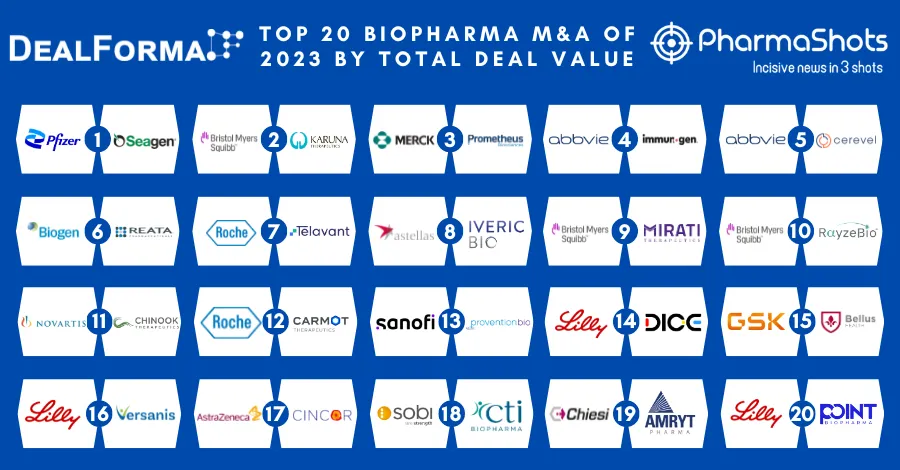

Related Post: Top 20 Biopharma M&A of 2022 by Total Deal Value

Tags

Shivani is a content writer at PharmaShots. She has a keen interest in recent innovations in the life sciences industry. She covers news related to Product approvals, clinical trial results, and updates. She can be contacted at connect@pharmashots.com.